Activating ICICI Bank’s iMobilePay app opens up an easy, secure way to manage all your banking needs right from your phone. From checking balances and transferring money to paying bills and more, the app gives you complete control over your finances anytime, anywhere. This guide will walk you through each step to get iMobilePay activated, so you can start banking on the go with confidence and ease.

How to Activate ICICI Bank Mobile Banking (iMobilePay): A Complete Guide

Getting ICICI Bank’s iMobilePay app set up on your phone makes it easy to manage your banking needs anytime and anywhere. Whether you want to check balances, transfer money, or pay bills, iMobilePay offers a secure way to handle banking on the go. Follow these simple steps to get started.

Step 1: Ensure Your Registered Mobile Number is Inserted

Before you start, make sure that the mobile number registered with your ICICI Bank account is inserted into your device. The app will send an SMS for verification, so it’s essential that this number is active on your phone.

Step 2: Download and Install the iMobilePay App

Go to the Google Play Store (for Android) or the App Store (for iOS) on your phone. Search for “iMobilePay by ICICI Bank,” and download and install the app. Once installed, open iMobilePay to begin the setup.

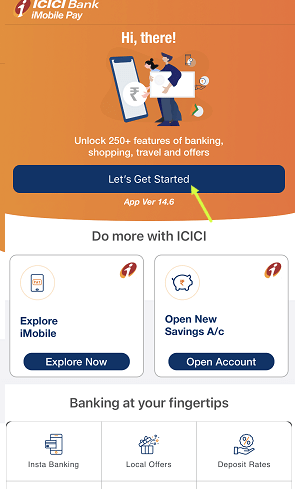

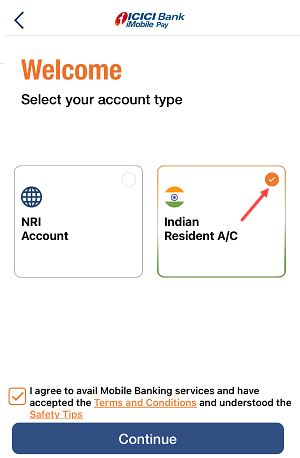

Step 3: Start the Activation Process

When you open iMobilePay for the first time, tap the “Let’s Get Started” button on the main screen. Then, select the “Indian Resident A/c” option if you have an account registered in India.

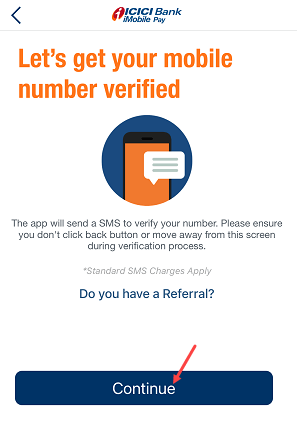

Step 4: Verify Your Registered Mobile Number

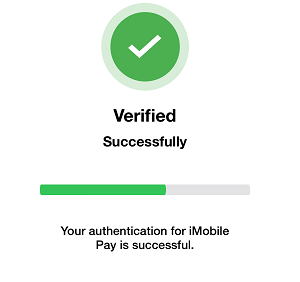

The app will request permission to verify your registered mobile number by sending an SMS from your phone. Allow the app to send this SMS for verification. Within a few seconds, you should see a message confirming that your mobile number has been successfully verified.

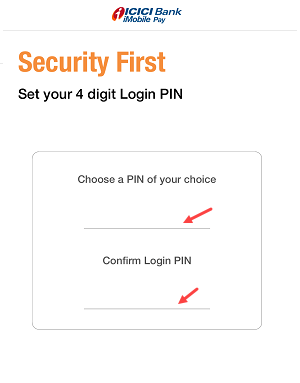

Step 5: Set a 4-Digit Login PIN

Once your mobile number is verified, create a 4-digit PIN to secure your iMobilePay app. This PIN will serve as your login credential each time you access the app. Choose a PIN that is easy for you to remember but difficult for others to guess, and confirm it if prompted.

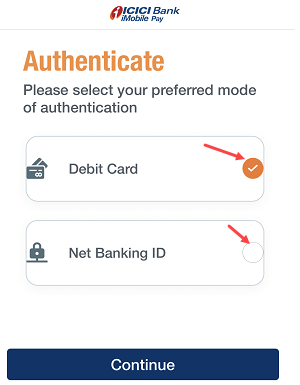

Step 6: Choose Your Activation Method

To complete activation, you have two options: using a debit card or via Net Banking.

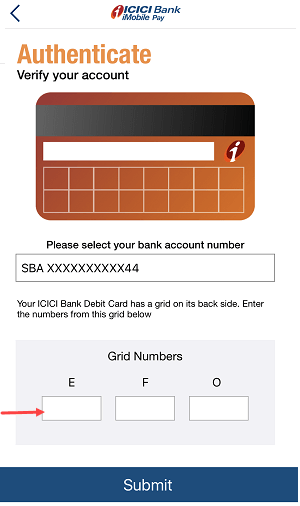

Option 1: Activate Using Debit Card

If you choose the Debit Card option, take your ICICI debit card and locate the grid of numbers on the back. These numbers are unique identifiers used for security purposes. Enter the grid values as requested by the app and submit. If the details match, your account will be activated.

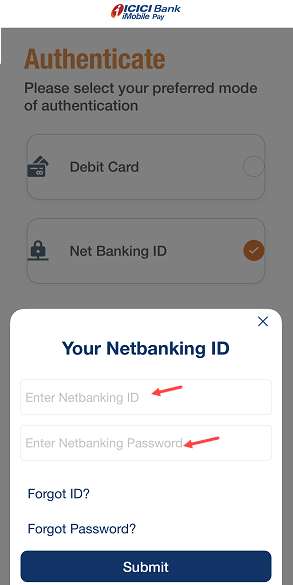

Option 2: Activate Using Net Banking

Alternatively, if you prefer Net Banking, select this option and enter your User ID and Login Password for ICICI’s Net Banking. After you submit these credentials, the app will verify them to complete the activation.

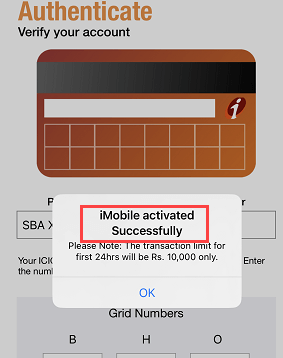

Step 7: Confirmation of Activation

Once your details are confirmed, you’ll see a message indicating that your iMobilePay is successfully activated. Congratulations! You’re now ready to use ICICI Bank’s mobile banking features.

Features Available on iMobilePay

With your iMobilePay app activated, you can now manage your finances with ease. The app lets you check account balances, view recent transactions, and download statements right from your phone. You can also transfer funds instantly using IMPS, NEFT, or RTGS and handle all your bill payments, mobile recharges, and ticket bookings.

FAQs

Q: Can I activate iMobilePay without a debit card?

Yes, if you don’t have your debit card on hand, you can use your ICICI Net Banking credentials instead.

Q: Is iMobilePay safe to use?

Yes, the app has multiple security features, including SMS verification, a login PIN, and data encryption, ensuring a safe banking experience.

Q: What if I need to update my registered mobile number?

If you change your mobile number, visit an ICICI branch or contact their support team to update your information.

Q: Can I reset my 4-digit login PIN if I forget it?

Yes, you can reset your PIN within the app by verifying your identity through your registered mobile number.

By following these steps, you’ll have ICICI Bank’s iMobilePay fully activated, giving you access to convenient mobile banking right at your fingertips. Enjoy managing your finances effortlessly and securely!