State Bank of India (SBI), the largest public sector bank in India, offers an easy and convenient way to access basic banking services through its Missed Call Banking Service. This free service allows you to check your account balance and mini statement by missed call (toll-free numbers) without needing internet access. All you need is a mobile number registered with your SBI account.

If you’re wondering how to activate this service and start using it, follow this detailed guide.

How To Activate SBI Missed Call Banking for Free

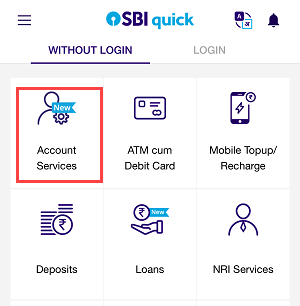

Step 1: Begin by installing the SBI Quick application on your smartphone. You can find this app on the Google Play Store for Android users or the Apple App Store for iOS users. Search for “SBI Quick” in your respective app store and download the app.

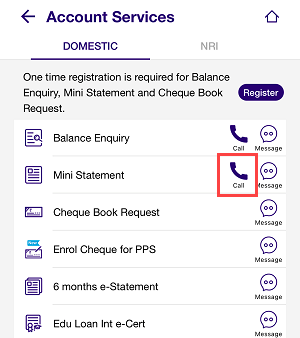

Step 2: Once the app is installed, launch it on your device. After opening the app, navigate to the Account Services section. This is where you will find the options to register and activate the SBI Quick services.

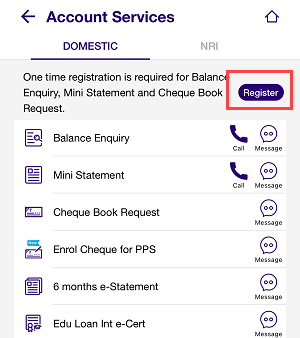

Step 3: Inside the Account Services section, you’ll see a Register option. Tap on it to proceed.

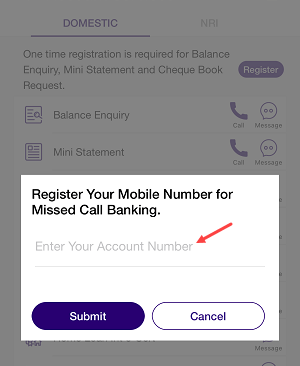

Step 4: A screen will appear prompting you to enter your SBI account number. Make sure to enter the correct account number to avoid errors. After entering your account number, tap on the Submit button.

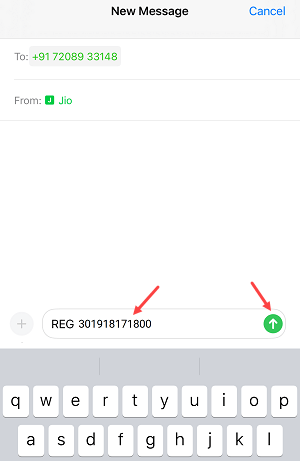

Step 5: Once you tap Submit, the app will redirect you to your phone’s messaging app. Here, a pre-filled SMS will appear, ready to be sent to the official registration number. You simply need to tap the Send button to complete this step.

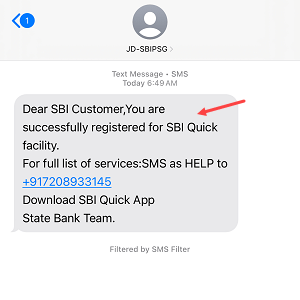

Step 6: After sending the SMS, wait for a reply from SBI. You will receive an SMS confirming your successful registration for the SBI Quick service. This message confirms that SBI Missed Call Banking is now active for your account.

How to Check SBI Account Balance by Missed Call for Free

Once the SBI Missed Call Banking service is activated, you can check your account balance anytime by following these steps:

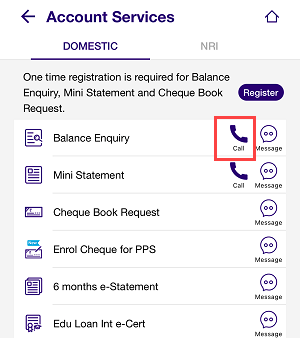

Step 1: Open the SBI Quick application on your phone. Tap on the call button in the Balance Inquiry option within the app.

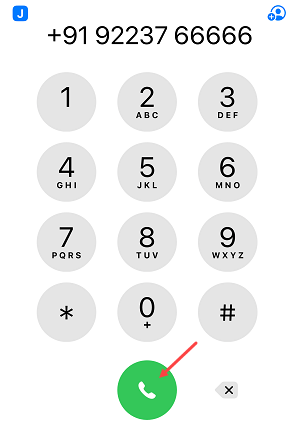

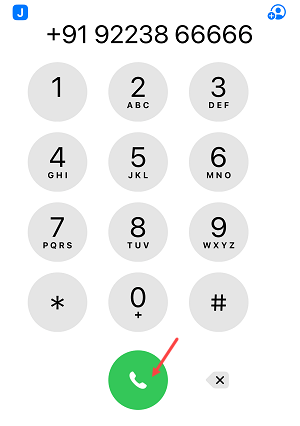

Step 2: The app will redirect you to your phone’s dialer screen. From there, you’ll see a toll-free number pre-filled for balance inquiries. Tap the call button to dial the number. The call will disconnect automatically within a few seconds.

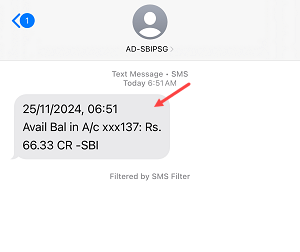

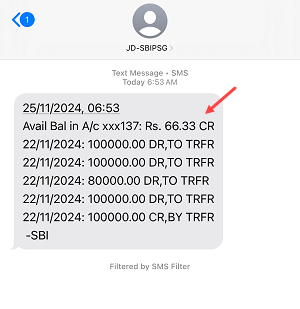

Step 3: After the call disconnects, you will receive an SMS from SBI containing your account balance details.

How to Check SBI Mini Statement by Missed Call for free

To view your recent transactions using the SBI Quick service, follow these steps:

Step 1: Open the SBI Quick app and look for the Mini Statement option. Tap on call button.

Step 2: Just like with balance inquiries, you’ll be redirected to the phone’s dialer screen with a toll-free number for mini statements pre-filled. Press the call button to dial this number. The call will disconnect automatically.

Step 3: Within a few seconds, you’ll receive an SMS with a mini statement that includes the last few transactions made on your account.

Pro Tips for Efficient Use

- Save Toll-Free Numbers: Save the toll-free numbers for balance inquiries and mini statements in your phonebook for quicker access.

- Retry if Needed: If you don’t receive the SMS immediately, try dialing the number again.

FAQs

Q1: Is the SBI Missed Call Banking service free?

Yes, the service is entirely free. However, standard SMS charges may apply based on your mobile carrier’s plan.

Q2: Can I use this service if my mobile number is not registered with SBI?

No, your mobile number must be registered with your SBI account to use this service.

Q3: How soon will I receive the balance or mini statement SMS?

You will typically receive the SMS within a few seconds after making the missed call.

Q4: What should I do if I don’t receive an SMS?

If you don’t get an SMS after dialing the toll-free number, ensure your mobile number is registered with your SBI account and that there are no network issues. Then try again.

Q5: Where can I find the toll-free numbers?

The toll-free numbers for balance inquiries and mini statements are available within the SBI Quick app. Save these numbers for future use.