You can transfer your Mobikwik wallet money to bank account if your KYC is complete. Only KYC complaint users can withdraw Mobikwik wallet money to bank.

Here is step by step guide – how to transfer Mobikwik money to Bank account instantly.

Before you start, let me tell you daily transfer and transactions limits.

- Read also: Change Mobikwik registered mobile number

Transfer limits:

The daily transfer limit is Rs.10,000 that mean you can send up to 10,000 per day to Bank account. And only 5 daily transfers allowed. The monthly transfer limit per beneficiary is Rs. 1 lac and 30 transfer allowed.

Now see how to withdraw mobikwik wallet money to bank account.

Mobikwik to Bank Account Transfer

Please note, only KYC complaint users can withdraw wallet money to Bank account. If your KYC is not done, then you can not transfer money to bank account.

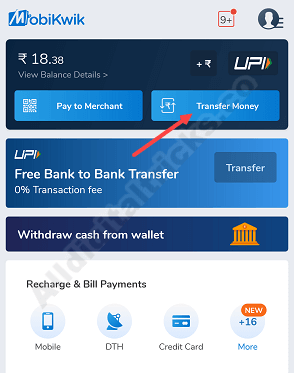

Step 1: Login to your Mobikwik wallet and tap on Transfer money.

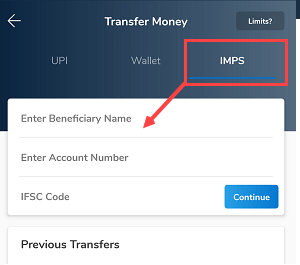

Step 2: On the next screen, select IMPS option and enter the beneficiary name, Bank account number, and IFSC code.

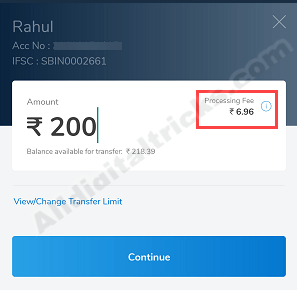

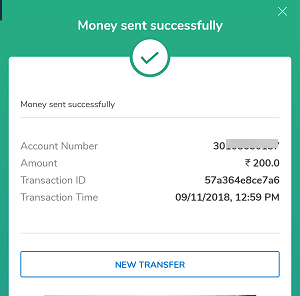

Step 3: Now enter the amount below 10,000 and tap on continue. Please note, minimum transfer limit is Rs.200 so below 200 amount cannot be transferred.

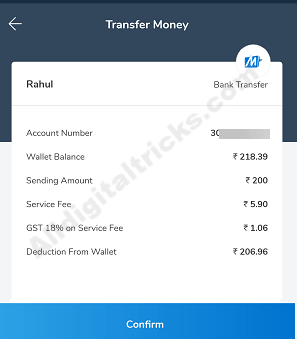

Step 4: Finally confirm your request. You can see applicable charges for Bank transfer. (Wallet to Bank account transfer is chargeable). Tap on confirm.

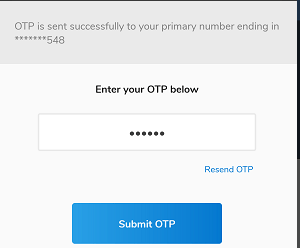

Next screen, enter security PIN if you set and then enter OTP received on your mobile number.

Done! your Mobikwik wallet money sent to Bank account. It will be credited to the bank account instantly.

How Bank Processing fee (charge) calculated? (Mobikwik Bank transfer charges)

- For KYC users, IMPS fee is 2.95% plus GST. If a KYC user does a transfer of Rs.1000, the user will be charged Rs.29.50+GST =34.81

- For non-KYC user, IMPS transfer is not allowed as per RBI guidelines.

So this is how to transfer money from Mobikwik wallet to Bank account. You can withdraw 10,000 daily from your wallet.