Managing finances digitally has become an integral part of daily life, and NEFT (National Electronic Funds Transfer) is one of the most reliable ways to send money electronically. With IDFC First Bank Mobile Banking, you can quickly and securely transfer funds to any bank account in India. The process involves adding a beneficiary (payee) and then transferring the desired amount, all within minutes.

This guide will walk you through the detailed steps to make an NEFT transfer using the mobile banking app. Whether you’re transferring a small amount or handling high-value transactions, IDFC First Bank’s seamless interface makes the experience hassle-free.

How to Transfer Money via NEFT in IDFC First Bank Mobile Banking

Before transferring money through NEFT, it’s essential to add the recipient’s account as a beneficiary. This is a mandatory step to ensure the transaction is secure and the funds reach the correct account. Once the beneficiary is added and verified, you can initiate money transfers with ease.

Step 1: Add a Payee Bank Account

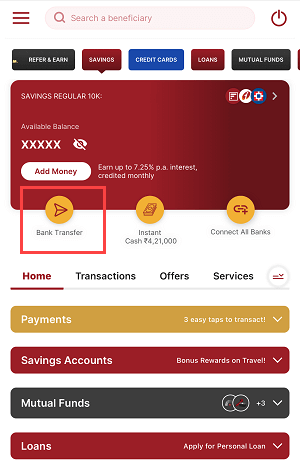

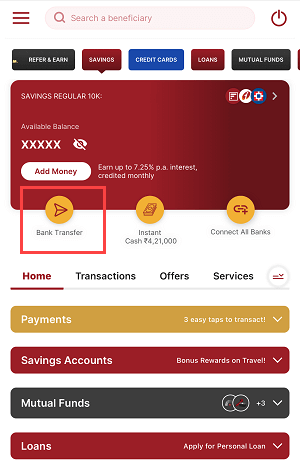

Step 1: Log in to the IDFC First Bank Mobile Banking App using your credentials. Once logged in, tap on the “Bank Transfer” option available on the dashboard.

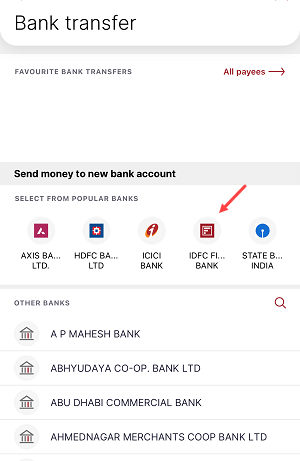

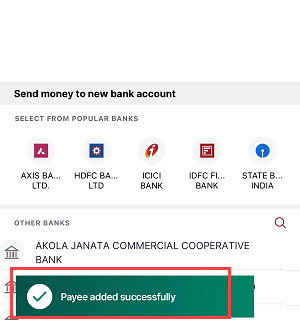

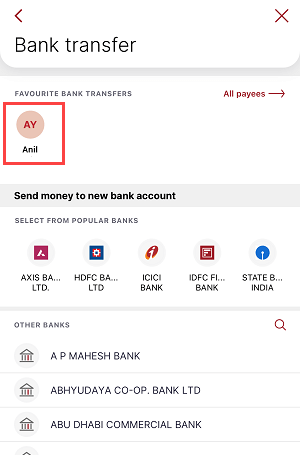

Step 2: On the next screen, select the bank where the recipient holds their account.

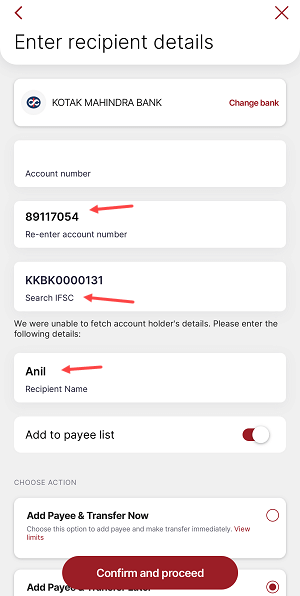

Step 3: Enter the beneficiary’s details, including the account number, IFSC code, and name. Ensure that all details are correct to avoid transfer issues.

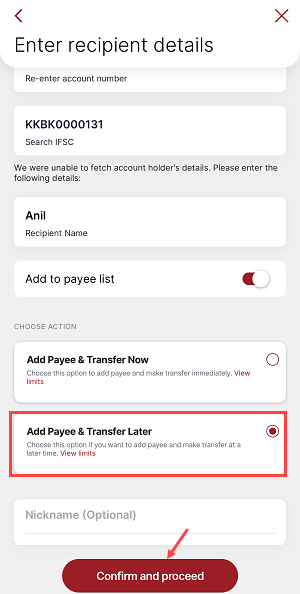

Step 4: Tap on “Add Payee & Transfer Later”, then click “Confirm and Proceed” to finalize the addition.

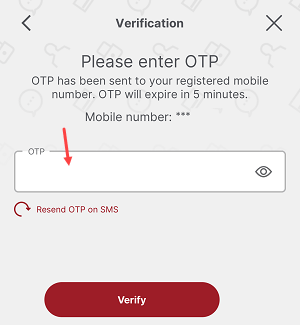

Step 5: An OTP (One-Time Password) will be sent to your registered mobile number. Enter this OTP to verify and complete the process.

Step 6: Once verified, a confirmation message will appear stating that the payee has been successfully added. You can now transfer money to this account.

Step 2: Transfer Money via NEFT

Step 1: Log in to the IDFC First Bank Mobile Banking App and select the “Bank Transfer” option.

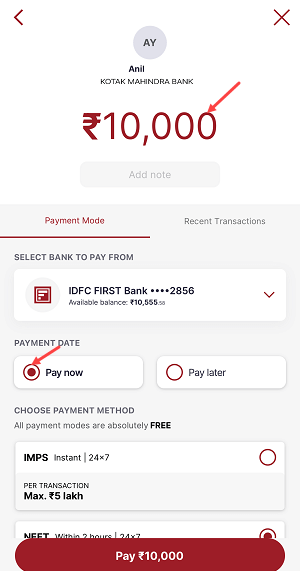

Step 2: Choose the added payee from the list of beneficiaries.

Step 3: Enter the amount you wish to transfer. If the payee was recently added, ensure the amount does not exceed ₹30,000 within the first 24 hours. For payees added earlier, you can transfer up to ₹20 lakh. You can transfer up to 20 lakh after 24 hours.

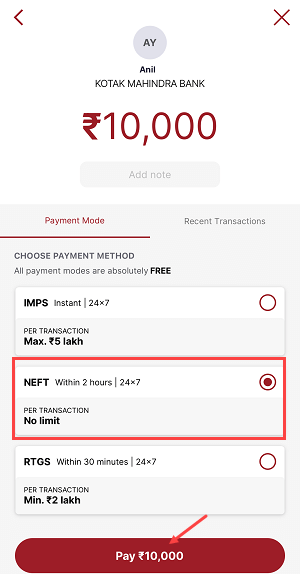

Step 4: Choose “Pay Now” and then select “NEFT” as the payment method.

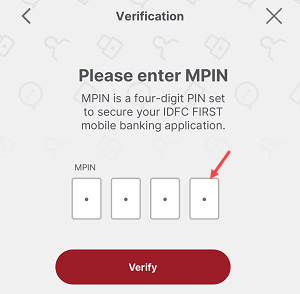

Step 5: Enter your MPIN to authenticate the transaction.

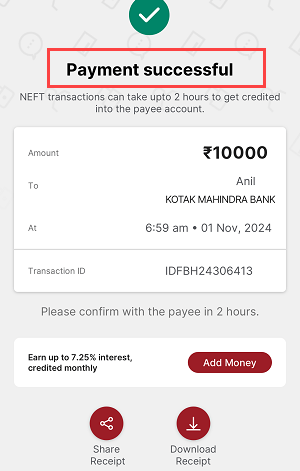

Step 6: Once processed, you will see a success message. The funds will be credited to the recipient’s account within one hour, and you will receive a confirmation SMS.

FAQs on NEFT Transfers in IDFC First Bank

Q1: What is NEFT, and why should I use it?

NEFT (National Electronic Funds Transfer) is a secure and reliable method for transferring money electronically between bank accounts across India.

Q2: How long does an NEFT transfer take?

NEFT transactions are typically processed within 1 hour, though this may vary depending on bank policies.

Q3: Is there a transaction fee for NEFT transfers?

Currently, IDFC First Bank does not charge any fees for NEFT transactions made through the mobile banking app.

Q4: What is the limit for NEFT transactions?

For newly added payees, the limit is capped at ₹30,000 during the first 24 hours. After this period, you can transfer up to ₹20 lakh per day.

Q5: What happens if my NEFT transfer fails?

If the transaction fails, the debited amount will be refunded to your account within 2-3 working days. You can contact customer support for further assistance.

By following these steps, you can easily transfer money using NEFT from your IDFC First Bank account. This method ensures secure and efficient fund transfers for all your personal and professional needs.