How do you transfer online more than 2 lac money from your SBI account to another bank account?

For this, you have 2 options, which enable you to send more than 2 lac amount online to any other bank account from your sbi account.

Those 2 options are: –

- NEFT (National Electronic Fund transfer)

- RTGS (Real Time gross settlement)

Using above 2 transfer mode, you can transfer money to any bank account maximum amount 10 lac.

Today I am going to tell you how you can send more than 2 lakh amount online from your SBI account to any other bank account.

Online Transfer More than 2 lac from SBI to Other Bank

You can transfer below 2 lac amount using IMPS and UPI. But for higher transactions, you can choose NEFT and RTGS payment options.

You can transfer more than 2 lac through NEFT & RTGS, let’s see how?

1. Add Beneficiary

To transfer money online, you need to add Beneficiary first, which means you need to approve the beneficiary person’s account details.

To add a beneficiary, first have to login in SBI Internet banking.

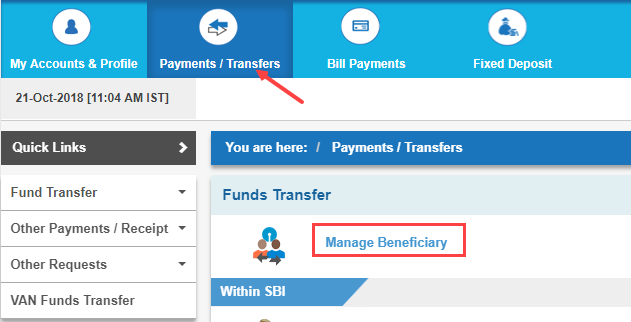

After logging in, you have to click the Payments/Transfers tab.

- In the Payments/Transfers tab, you have to click Manage beneficiary, next screen you will be asked for profile password.

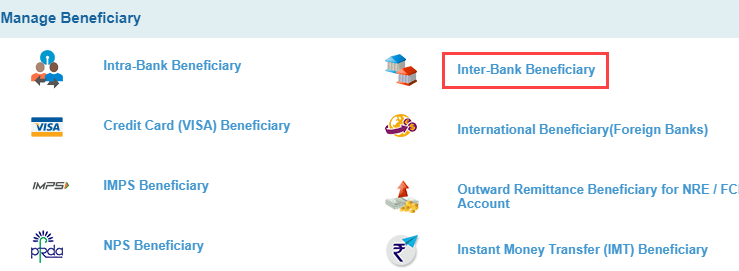

In the manage beneficiary, you have to click Inter-Bank Beneficiary.

Now you have to add Inter-Bank Beneficiary account details.

- Enter beneficiary name

- Now type his/her account number, type it again to confirm

- In transfer limit you need to add fund transfer limit, if you are transferring higher amount then enter maximum limit.

- Now enter the IFSC code

After entering the details of the person’s account, click on submit.

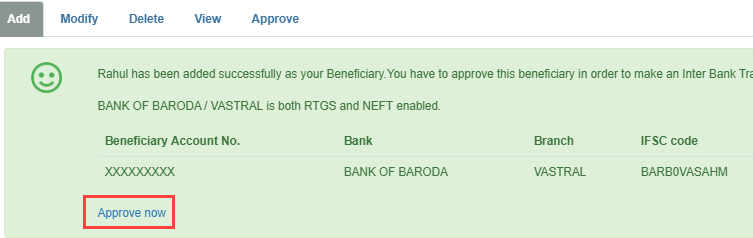

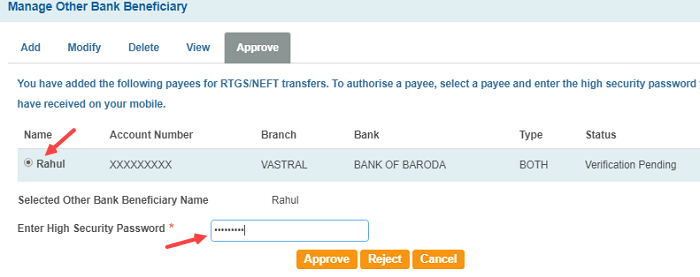

In the next screen, you will have to approve this Beneficiary. Click on Approve Now

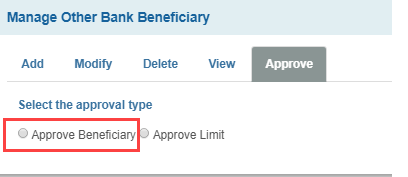

In the next screen, click on Approve beneficiary

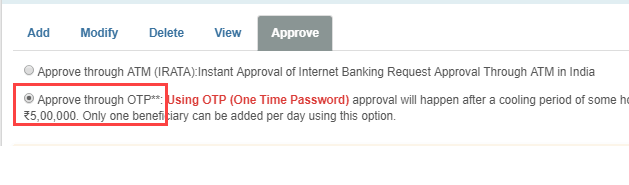

To approve beneficiary you have 2 options (1) Through ATM (2) Through OTP

- Here you have to select through the OTP option. Your mobile number now receive OTP password that will be entered in the next screen.

Now, in the next screen select Beneficiary account, enter the high-security password which has been sent to your mobile number, click on submit.

You have added the beneficiary account successfully. This beneficiary will be activated within 4 hours, after activation you can transfer money to his/her account.

After 4 hours, your added beneficiary will be activated, and now we are ready to send money to him.

Let’s transfer above 2 lac using NEFT or RTGS.

2. Send Money

As I told you that you can send more than 2 lakhs through NEFT & RTGS, let us send using these transfer modes.

Send more than 2 lakhs via NEFT

When you send money to someone via NEFT, it will take 4 hours to credit beneficiary’s account. If you send money on holidays, your money will be credited to his/her account in the next working day.

If you are an SBI normal customer, then NEFT is best option for online money transfer.

To send more than 2 lakh through NEFT from your SBI account to another bank account online, first log in to SBI Netbanking

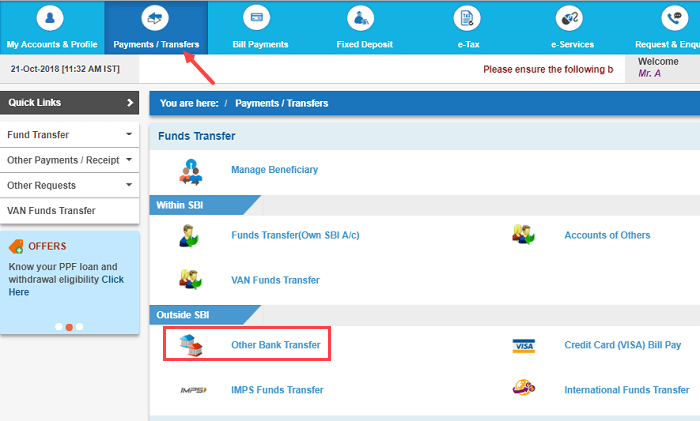

After logging in, you have to click on Payments / Transfers.

- In the payments/transfers, you have to clickon Other Bank Transfer.

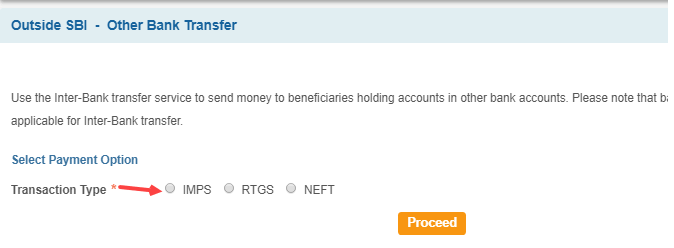

Now in the next screen, you will be given 3 options (1) IMPS (2) RTGS (3) NEFT

- Select NEFT option.

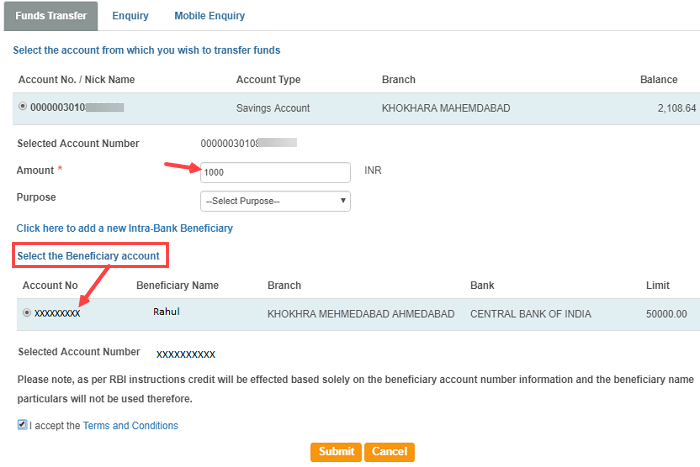

Now in the next screen you have to select your account, enter the amount which you want to transfer, select beneficiary that you have added and click on submit.

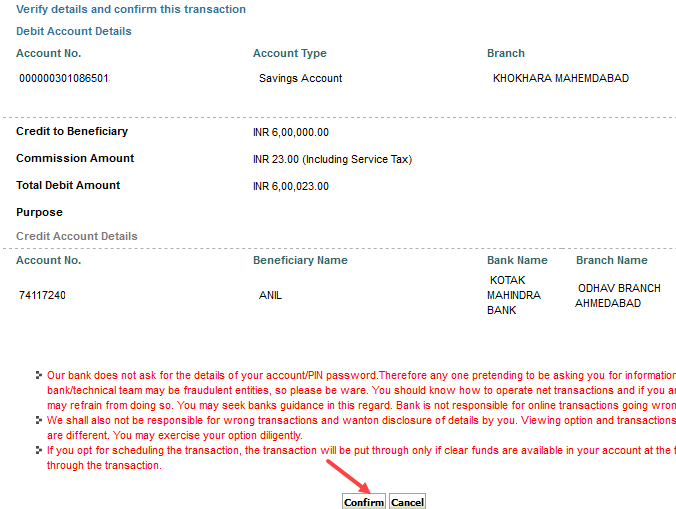

In the next screen you have to confirm your transaction so click confirm

You will now receive an OTP password on the registered Mobile Number which you have to enter in the next screen.

Done! You have successfully transferred Money to the beneficiary account, it will be credited within 4 hours.

Send more than 2 lakhs via RTGS

RTGS mean real-time gross settlement that means your transferred money will be credited to beneficiary’s account in real time (within seconds).

RTGS is using by companies, the business firm where higher amount transact daily.

In RTGS you can send minimum 2 lakh and a maximum 10 lakh amount. Below 2 lac, you can’t use RTGS.

Ok, so let’s transfer more than 2 lac via RTGS.

First, login to SBI net banking and click on Payments / Transfers

- In the payments/transfers, you have to click on Other Bank Transfer.

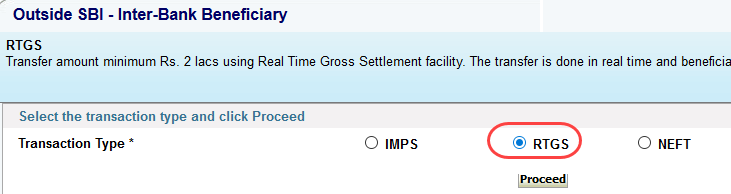

Now in the next screen, you will get 3 transfer mode options (1) IMPS (2) RTGS (3) NEFT

- Here you have to select RTGS.

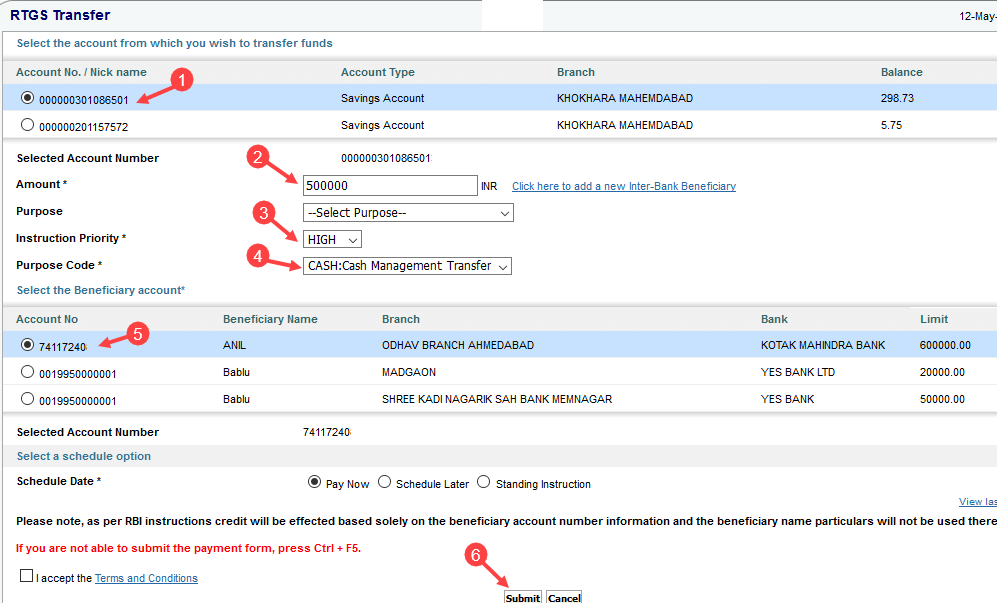

In the next screen you have to select your account, enter the amount, select High in the Instruction priority, select any appropriate option in the Purpose code, select the beneficiary account and click on Pay now.

Now confirm the transaction by clicking on Confirm in the next screen

You will receive an OTP password on your mobile number that you need to enter in the next screen in the high-security password.

Done! You have successfully sent money to the beneficiary’s account using RTGS, which will be credited immediately in his/her account.

So in this way you can transfer more than 2 lakh online money from your SBI Account to another bank’s account. If Amount is less than 2 lakh then you can select IMPS option, for that you have to add IMPS beneficiary.