Indian Bank customers can now open PPF account online using Internet Banking. You can submit the PPF account opening request online and get your PPF account instantly.

If you are an Indian Bank customer and want to open your PPF account then you don’t need to visit the bank. You can open your account online in just two steps by login to net banking.

Indian Bank PPF Account Opening Online

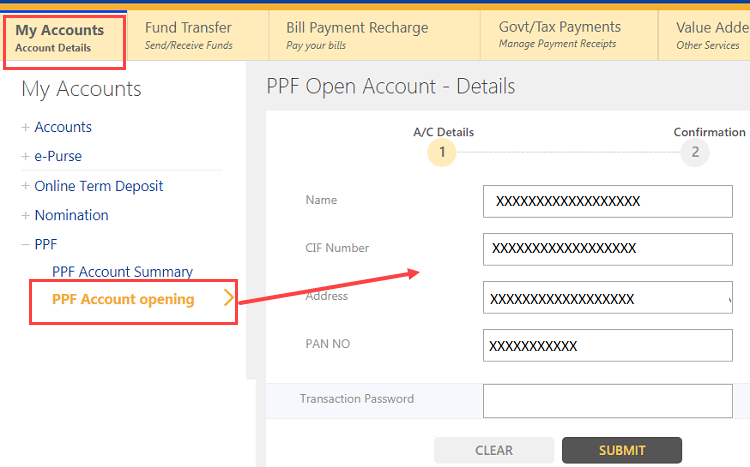

Login to Indian Bank Internet Banking.

Now click on My Accounts – PPF – PPF Account Opening. You can see your name, address, Pan details, confirm and submit.

Next screen confirm your details submit.

That’s it your PPF account will be opened.

After opening the PPF account online, you can transfer money into your PPF account online using net banking.

Important Notes:

- Any individual may on his own behalf or on behalf of a minor, of whom he is the guardian, can open PPF account under the scheme.

- The default period of the PPF Account is 15 years. A subscriber, if he so desires may extend the account beyond 15 years for a further block of 5 years within one year from date of maturity.

- The minimum subscription under the scheme is Rs.500/- per year and the maximum amount that can be invested under the scheme per year is Rs.1,50,000/- (which is eligible for Income Tax Benefit under section 80C).

- The number of remittances into an account per year shall not exceed 12.

- Customers can register nominee online if required after the successful creation of PPF Account.

- The customer has to contact the branch for withdrawal of amount/Closure/Availing of loan facility under the PPF Account.

FAQs

(1) Can I open the PPF account online in Indian bank?

Ans: Yes, you can open the PPF account in Indian Bank. If you have Indian Bank net banking then you can open your PPF account online.

(2) How to Fund my PPF account after opening it online?

Ans: You can fund your PPF account online by login to net banking.