In today’s digital era, managing finances through mobile banking has become a necessity. The Bank of Baroda mobile banking app (bob World) offers a secure and user-friendly platform to handle transactions anytime, anywhere. However, before transferring funds, it is mandatory to add the recipient as a beneficiary account in the app.

Adding a beneficiary enhances the security of your transactions, ensuring that funds are sent only to verified accounts. Whether you’re transferring money to a Bank of Baroda account or another bank, this guide will walk you through the detailed steps to register a beneficiary and enable seamless fund transfers.

ADD Beneficiary Bank Account in Bank of Baroda Mobile Banking

Adding a beneficiary account is a vital step for initiating secure and hassle-free money transfers through the Bank of Baroda mobile banking app (bob World). Whether you’re transferring funds within the same bank or to other banks, registering a beneficiary ensures your transactions are processed smoothly and accurately. This comprehensive guide will take you through the process step-by-step, making it easy to add beneficiaries and manage your financial transfers with confidence.

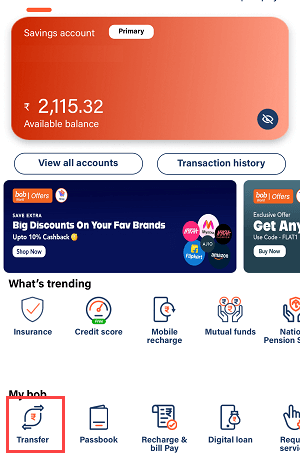

Step 1: Log in to the Bank of Baroda Mobile Banking App

Open the bob World app on your mobile device and log in using your registered credentials, such as your user ID and password or biometric authentication. After logging in, you will be directed to the app’s home screen.

Step 2: Navigate to the Transfer Option

On the home screen, find and tap the Transfer option. This will take you to the transfer section, where you can manage your beneficiary accounts and initiate fund transfers.

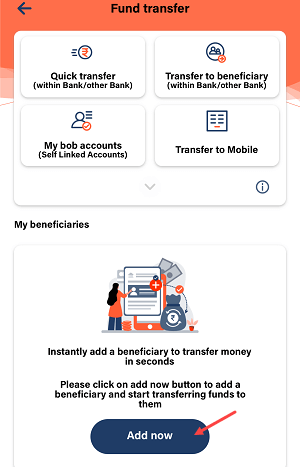

Step 3: Select the Add Beneficiary Option

If you haven’t added any beneficiaries yet, the app will display an Add Now option. Tap on it to start the process. If you already have beneficiaries listed, tap on View All and choose the Add a New Beneficiary option to add another recipient.

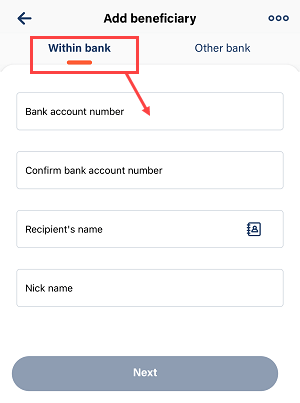

Step 4: Choose Beneficiary Type

You will be prompted to select the type of beneficiary:

- Within Bank for Bank of Baroda accounts.

- Other Bank for accounts held in other banks.

Step 5: Add a Bank of Baroda Beneficiary

If the recipient’s account is with Bank of Baroda, select the Within Bank option. Enter the beneficiary’s account number and name, and tap on the Submit button. You don’t need to input the IFSC code for Bank of Baroda accounts, as it is auto-validated.

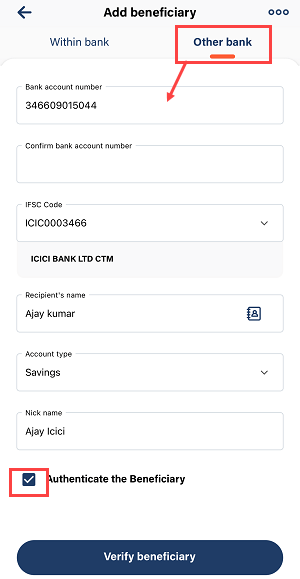

Step 6: Add a Beneficiary from Another Bank

If the recipient holds an account in another bank, select the Other Bank option. Provide the following details:

- Account number of the beneficiary.

- Full name of the beneficiary.

- IFSC code of the recipient’s bank branch.

- An optional nickname for easy reference.

After filling in the information, tap Authenticate Beneficiary and proceed with Verify Beneficiary.

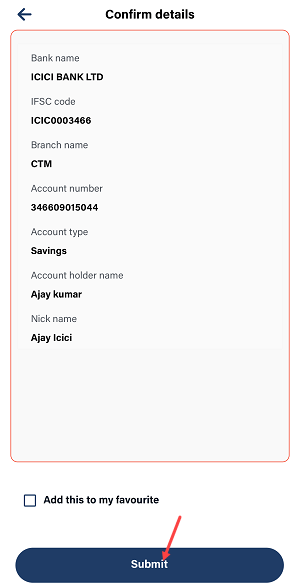

Step 7: Confirm Beneficiary Details

The app will display all the information you’ve entered. Carefully review the details on this screen. If everything is correct, tap Next to move to the final step.

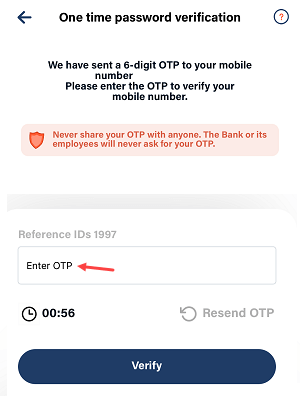

Step 8: Enter OTP for Authentication

You will receive a one-time password (OTP) on your registered mobile number. Enter the OTP in the app to confirm the addition of the beneficiary.

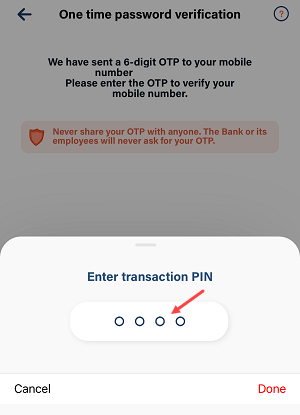

Step 9: Finalize with Transaction PIN

To complete the process, input your transaction PIN and submit.

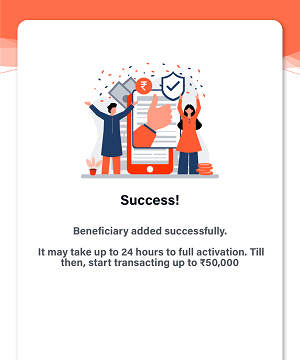

Step 10: Beneficiary Added Successfully

The beneficiary will now be added successfully. However, it will take 4 hours for the account to be activated.

Transfer Limits After Beneficiary Activation

After the activation period, you can begin transferring funds to the beneficiary account. The transfer limits are as follows:

- After 5 hours, transfer up to ₹50,000 via IMPS or NEFT.

- After 24 hours, the limits increase to ₹5 lakh via IMPS and ₹20 lakh through NEFT.

FAQs

1. Why do I need to add a beneficiary account for fund transfers?

Adding a beneficiary ensures that only authorized accounts can receive funds, enhancing transaction security and preventing errors.

2. How long does it take for a beneficiary to be activated?

The beneficiary account will be activated 4 hours after it is successfully added.

3. Can I transfer funds immediately after adding a beneficiary?

No, you must wait for the activation period to complete. After 5 hours, you can transfer up to ₹50,000.

4. What happens if I enter incorrect details while adding a beneficiary?

If incorrect details are submitted, the transaction may fail. Always double-check the details during the confirmation step.

5. Is the IFSC code required for Bank of Baroda accounts?

No, the IFSC code is not needed when adding a Bank of Baroda account as the beneficiary.

6. Are there any charges for adding a beneficiary?

No, adding a beneficiary in the bob World app is free of charge.

Adding a beneficiary account is a critical step for secure and efficient fund transfers. By following these detailed instructions, you can quickly set up beneficiaries and enjoy the convenience of digital banking with the Bank of Baroda mobile app.