Now you can apply for Instant PAN Card (e-PAN) online trough the Income-tax official website. Instant PAN card facility available for the limited time period and only resident individuals can apply for Instant PAN online.

What is the Instant Pan card (e-PAN)?

Instant Pan card is digitally signed PAN Card issued in electronic format by the Income Tax Department using Aadhaar e-KYC. This facility is available to Individual PAN Applicants who have been allotted an Aadhaar number by UIDAI and is required to file PAN application in Form 49A being an Indian citizen.

- Easy & paperless process

- Get Pan Within 10 minutes

- Holds the same value as physical Pan card

- All you need Aadhaar card and Aadhaar linked Mobile Number

Instant PAN allotment in near to real-time is available at free of cost. Individuals (other than minors) with a valid Aadhaar number (with an updated Mobile number) can avail the PAN allotment facility.

Apply for Instant PAN card Online (e-PAN)

Before you start, please read first:-

- If you have already Pan card, you can’t apply for this.

- This facility only for resident individuals, except minors, companies, firms, trust, etc.

- You have valid Aadhaar number and Aadhaar registered mobile number to receive OTP.

Now follow below Step by step process:-

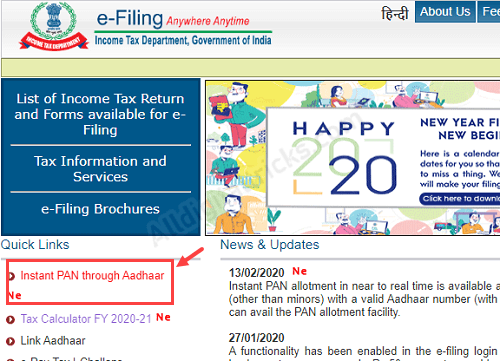

1: Visit Income tax official website: https://www.incometaxindiaefiling.gov.in/

- Click on Instant PAN through Aadhaar as you can see below screenshot.

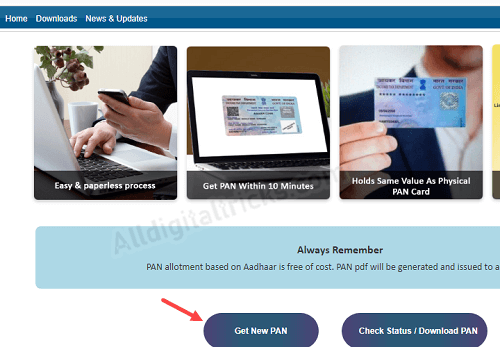

2: Next screen click on Get New PAN Button and proceed further.

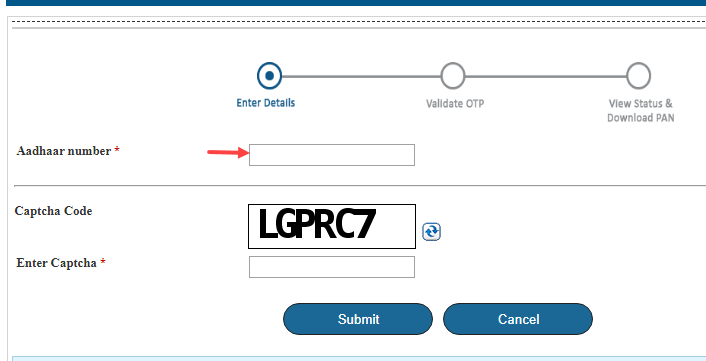

3: Now enter your Aadhaar card number and click on Generate Aadhaar OTP.

- You will receive an OTP on your Aadhaar registered mobile number. Enter OTP in the validate OTP.

- After entering OTP, you can see your Aadhaar card details, validate these details and you are almost done.

- You can also enter your email ID and validate it.

- After successful submission, an acknowledgment number will be sent to your Aadhaar registered mobile number and email ID. Please keep this acknowledgment number for future reference.

Download Instant Pan Card

To download your Instant Pan card, please visit the Income-tax official website: https://www.incometaxindiaefiling.gov.in/

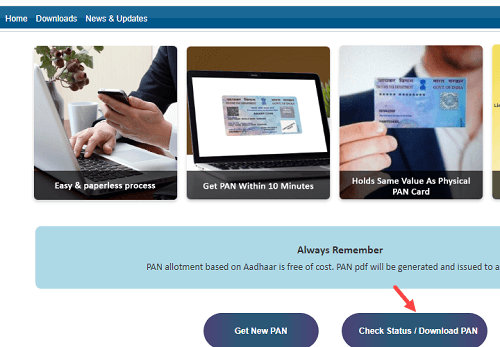

- Click on Instant PAN through Aadhaar

Now click on Check Status/Download PAN button.

Next screen enter your Aadhaar card number and submit. Enter OTP which sent to your Aadhaar registered mobile number and validate.

Check the status of your application whether PAN allotted or not.

If Pan is allotted, just click on the download button and download your instant Pan in PDF format.

So this is how you can apply for Instant Pan online using your Aadhaar card and get Pan number instantly. After getting your instant Pan, you can also apply for the physical copy of your Pan card online by following this process: How to get reprint Pan card online

FAQ

Q.1: What is Aadhaar based Instant Pan card (e-PAN)?

Ans: This facility enables you to get Instant Pan in PDF format using your Aadhaar card number. Later, you can apply for the physical copy of the Pan Card. If you need to Pan card urgent then this facility will help you.

Q.2: Any charges for this Instant Pan facility?

Ans: No, this facility is free of cost.

Q.3: After applying Instant Pan (e-PAN), how to get my Pan?

Ans: it will be sent to your email address which you entered during the applying process and yes you can also download it, please read the above guide.