Investing in mutual funds is a great way to grow your wealth over time, and there are two ways to do it on the Groww application: through a Systematic Investment Plan (SIP) or a lump-sum payment. In this article, we will guide you through the process of making a one-time investment in a mutual fund on Groww.

If you are not interested in starting an SIP, you still have the option to invest a lump-sum amount in any mutual fund scheme to begin your investment journey. To do so, you can follow these step-by-step instructions and invest your lump-sum amount in a mutual fund scheme on the Groww app.

Invest Lump-Sum Amount in Mutual Fund Scheme using Groww Application

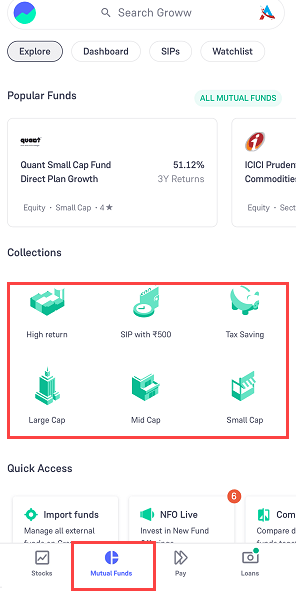

Step 1: Firstly, open the Groww application and select the “Mutual Fund” section. Here, you can choose from a wide variety of mutual funds that are available to invest in based on your risk preference. If you prefer high returns with high risk, you can select small-cap and mid-cap mutual funds. On the other hand, if you prefer moderate returns with low risk, you can select large-cap mutual funds.

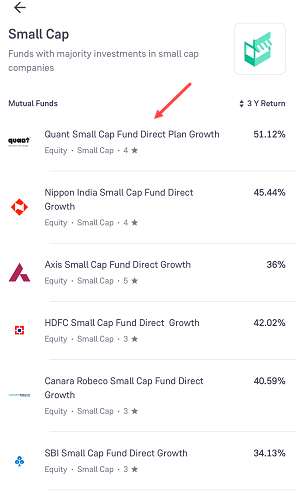

Step 2: Once you have selected your preferred mutual fund scheme, click on it to view the scheme details. For instance, let’s assume that you have chosen the “Quant Small Cap Fund Direct Plan-Growth” and you want to invest the lump-sum amount in this fund, then tap on it.

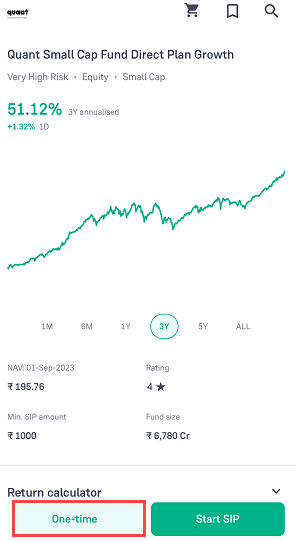

Step 3: On the next screen, you will see the mutual fund scheme chart and returns performance. Since you are investing a one-time (lump-sum) amount, select the “One-time” option.

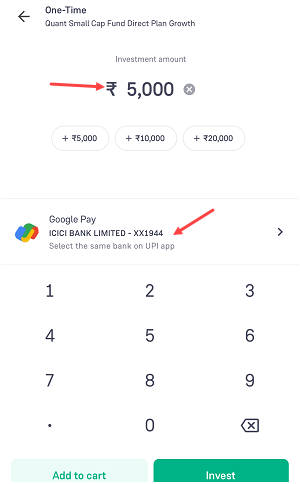

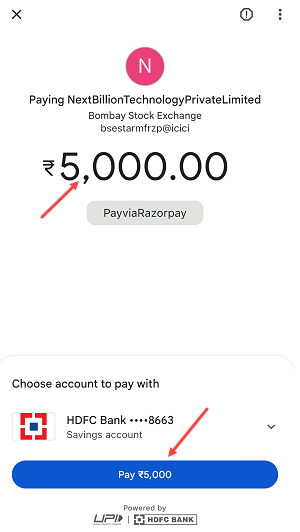

Step 4: Enter the amount you want to invest on the next screen. For example, if you want to invest Rs. 5000, enter this amount. Afterwards, select your preferred payment method.

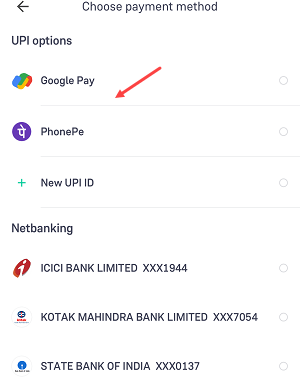

Step 5: You can pay using a UPI App like PhonePe, Google Pay, or any UPI ID. Alternatively, you can make your payment via net banking. Once you have selected your preferred payment method, make the payment.

Step 6: On the next screen, proceed to pay the amount using the selected UPI application. You will be redirected to the UPI application, where you need to authenticate the payment.

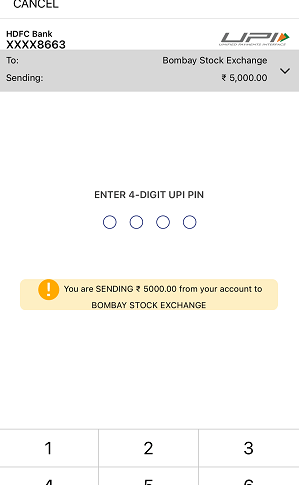

Step 7: Enter your UPI PIN to complete the transaction.

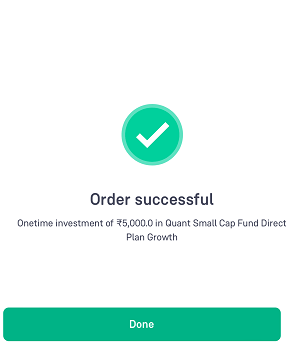

Step 8: Congratulations! You have successfully invested a one-time (lump-sum) amount in your preferred mutual fund scheme. You can see the Order Successful screen after successful payment.

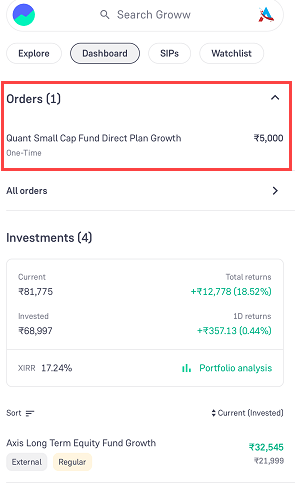

Step 9: Currently, your investment is under process and open. You need to wait for 4-5 working days to complete the order. During this time, the mutual fund (AMC) will receive your payment, and applicable units will be allotted to your account.

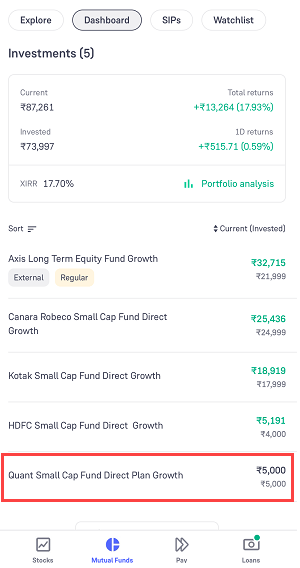

Step 10: After successful unit allocation, you can see your investment in your mutual fund portfolio section. You can access your portfoilo by clicking on the “Mutual Fund” tab in the bottom menu bar of the Groww application.

Step 11: If you want to invest more in the future, open the portfolio, select the mutual fund scheme you have invested in, and select the “One-time” option to pay the amount.

In summary, this is how you can invest a one-time (lump-sum) amount in a mutual fund on Groww. By following these simple steps, you can start growing your wealth and achieve your financial goals.