Investing in mutual funds has become increasingly simple with platforms like Angel One, which provide easy access to a range of investment options. However, withdrawing mutual funds—whether partially or fully—can sometimes seem confusing for first-time users. Whether you’re withdrawing funds for personal needs or reshuffling your portfolio, knowing the exact steps is crucial.

Angel One offers a streamlined process for redeeming mutual funds via its mobile application. In this article, we provide a detailed, step-by-step guide to help you successfully withdraw your mutual funds. Additionally, we’ll answer frequently asked questions about withdrawal timelines, NAV pricing, and more to give you a comprehensive understanding.

How To Sell Mutual Funds & Withdraw Money on Angel One Demat Account

Please note, Not all mutual funds can be sold or withdrawn at any time. Some funds, such as ELSS (Equity Linked Savings Scheme), come with a mandatory lock-in period of 3 years. This means you cannot redeem or withdraw your investment until the completion of the lock-in period. ELSS funds are designed to encourage long-term savings and offer tax benefits under Section 80C of the Income Tax Act. After the lock-in period ends, you can choose to sell the units partially or fully based on your requirements.

Follow these steps carefully to redeem your mutual funds via the Angel One mobile app:

Step 1: Log in to the Angel One Mobile App

- Open the Angel One app on your smartphone.

- Use your login credentials (User ID and Password) to access your Demat account.

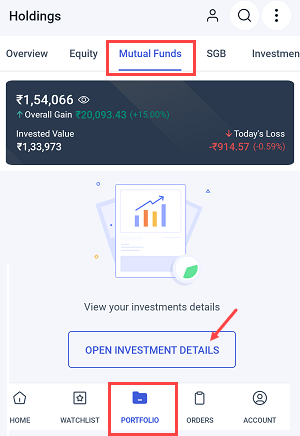

- After logging in, navigate to the Mutual Funds Portfolio section by selecting it from the main menu or dashboard.

Step 2: Choose the Mutual Fund to Withdraw

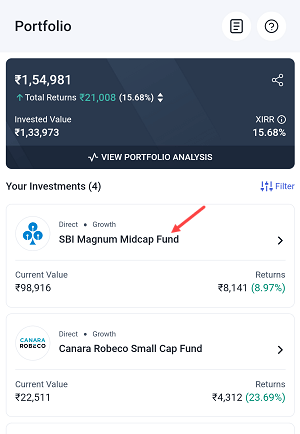

- Once inside the Mutual Funds Portfolio, you’ll see a list of mutual funds you own.

- Tap on the specific mutual fund you wish to withdraw money from.

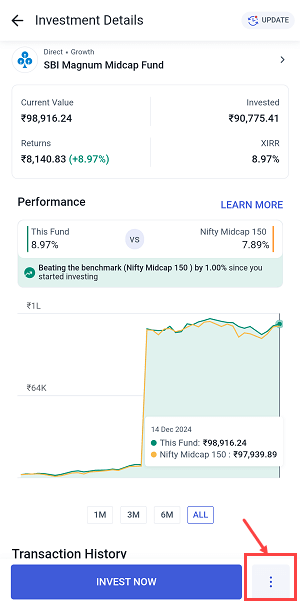

Step 3: Open the Options Menu

- On the mutual fund details screen, look for the three vertical dots (menu icon) usually located at the bottom-right corner of the screen.

- Tap on this icon to reveal additional options for the selected mutual fund.

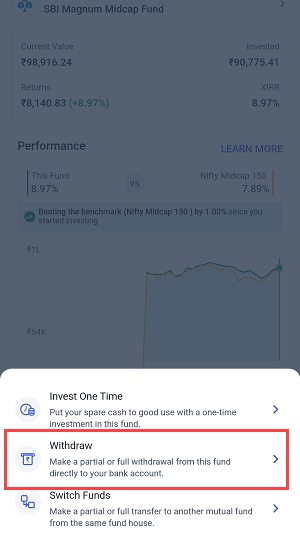

Step 4: Select the Withdraw Option

- From the dropdown menu, select the Withdraw option. This will initiate the redemption process.

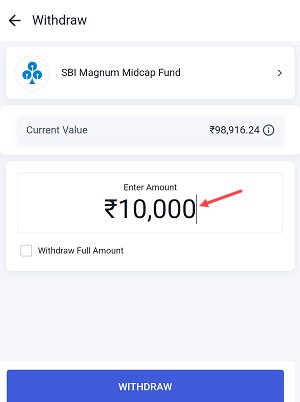

Step 5: Decide Between Partial or Full Withdrawal

- The app will now present you with two options:

- Partial Withdrawal:

- Enter the specific amount you want to redeem.

- Ensure that the amount does not exceed your available balance.

- Proceed to the next step to confirm the withdrawal.

- Partial Withdrawal:

-

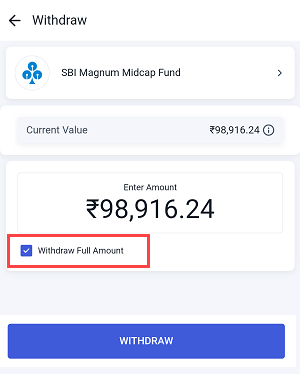

- Full Withdrawal:

- Select the option to Withdraw Full Amount.

- This will sell all the units of the selected mutual fund.

- Full Withdrawal:

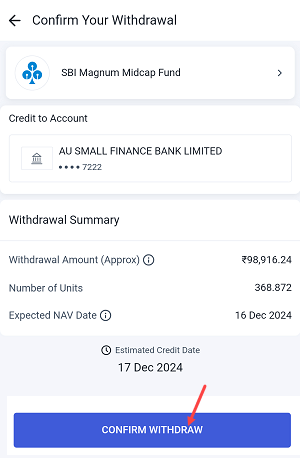

Step 6: Confirm the Withdrawal Request

- Once you’ve chosen between partial or full withdrawal, review the details of your redemption request.

- Check the units or amount you’re withdrawing and tap on the Confirm Withdraw button to proceed.

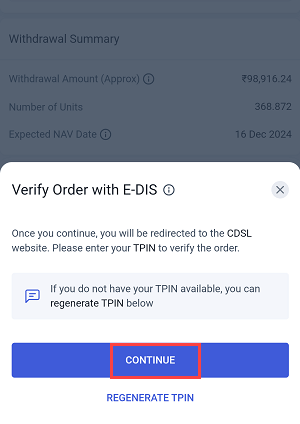

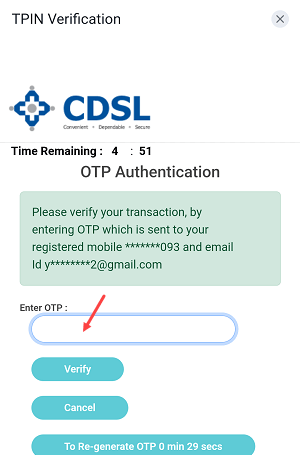

Step 7: Authenticate the Withdrawal with TPIN and OTP

To ensure a secure transaction, the system will require you to authenticate your withdrawal request:

- Enter TPIN:

- If you don’t have your TPIN, click on Regenerate TPIN. A new TPIN will be sent to your registered mobile number via SMS.

- Enter OTP:

- An OTP will be sent to your registered mobile number and email ID. Enter the OTP in the app to verify your identity.

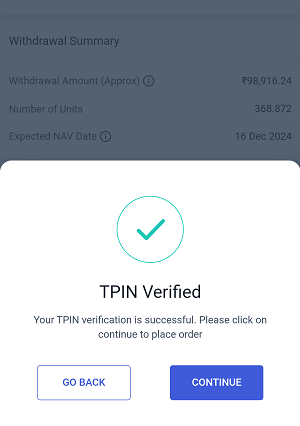

Step 8: Submit and Finalize

- After verifying with TPIN and OTP, tap on the Continue button.

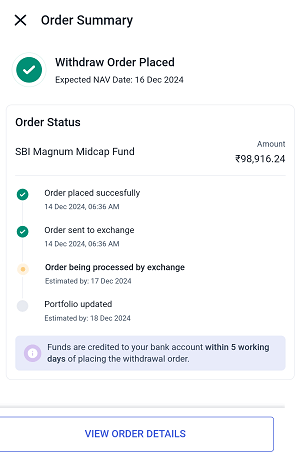

Done! you have successfully sold your mutual funds unit. You can see your order summary on the screen in the portfolio section.

When Will the Money Be Credited?

The time taken for your withdrawn amount to reflect in your bank account depends on when you place the redemption request:

- During Market Hours (9:15 AM to 3:00 PM):

- If the request is placed during market hours, you’ll receive the same day’s NAV price.

- The credited amount will typically reflect in your bank account within T+1 to T+3 business days, depending on the mutual fund type.

- After Market Hours (Post 3:30 PM):

- Requests placed after market hours are processed using the NAV of the next trading day.

- Funds will be credited within 1-3 business days after the next trading day.

- Liquid Funds:

- Redemption of liquid funds often happens faster, with funds credited within 24 hours in most cases.

FAQs about Withdrawing Mutual Funds from Angel One

1. Can I cancel a withdrawal request?

No, once a mutual fund redemption request has been placed and processed, it cannot be canceled. Ensure you review all details before confirming.

2. What is a TPIN, and how do I get one?

A TPIN (Transaction PIN) is a security feature that authenticates your transaction. If you don’t know your TPIN, you can regenerate it directly through the Angel One app. A new TPIN will be sent to your registered mobile number via SMS.

3. Will I incur charges for withdrawing mutual funds?

Most mutual funds do not charge for redemption. However, if you withdraw within the lock-in period or before the specified duration, an exit load fee may apply. Review the mutual fund’s terms and conditions for details.

4. How do I know if my withdrawal request is successful?

You will receive a confirmation message on the Angel One app after placing the withdrawal request. Additionally, you’ll get an SMS and email notification once the transaction is processed.

5. Why is my withdrawal amount lower than expected?

The withdrawn amount may differ due to:

- Exit load charges (if applicable).

- NAV fluctuations between the time of request and processing.

- Tax deductions, if any.

6. Can I withdraw funds on holidays?

You can place a withdrawal request on holidays, but the NAV price applied will be based on the next market day when the markets reopen.

Final Thoughts

Withdrawing mutual funds from your Angel One Demat account is a straightforward process once you know the steps. Whether you’re opting for a partial redemption or selling all your units, the Angel One mobile app ensures a secure and seamless experience.

Remember to check the NAV timing and redemption timelines before initiating the process to avoid any loss. Additionally, keep your TPIN and registered mobile number handy for authentication purposes.