The Public Provident Fund (PPF) is a favoured investment option in India, known for its tax benefits and steady returns. For ICICI Bank customers, accessing funds through a partial withdrawal from a PPF account is now easier with their online banking platform. This guide explains how to perform an online PPF withdrawal with ICICI Bank, covering eligibility and a step-by-step process to help you access your savings seamlessly.

Understanding PPF Partial Withdrawal

A partial withdrawal allows you to take out a portion of your PPF account balance before maturity. Per PPF rules, you can withdraw funds after 6 years from the end of the financial year when the account was opened. The maximum withdrawal is 50% of the balance at the end of the 4th year or the previous year, whichever is lower, and only one withdrawal is permitted per financial year.

For instance, if your PPF account was opened in May 2018, you’re eligible for a partial withdrawal starting April 2025. The amount depends on the balance as of March 31, 2021 (4th year) or March 31, 2024 (previous year).

Eligibility for PPF Withdrawal

To qualify for a partial PPF withdrawal, ensure:

- Your PPF account is at least 6 years old from the end of the opening financial year.

- You can withdraw up to 50% of the eligible balance.

- Only one withdrawal per year is allowed.

- The account must have regular deposits (minimum ₹500 annually) and no defaults.

How to Perform Online PPF Partial Withdrawal with ICICI Bank

ICICI Bank’s Internet Banking platform simplifies the PPF partial withdrawal process. Follow these steps to withdraw funds online:

Step 1: Access Your Net Banking Account

Go to the ICICI Bank website and log in to your Internet Banking account with your credentials. Keep your registered mobile number handy for OTP verification.

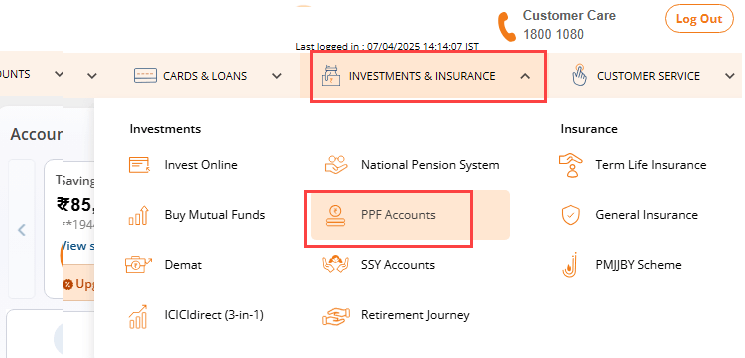

Step 2: Locate the PPF Accounts Section

In the dashboard, find the Investments and Insurance tab. Click on PPF Accounts to view your account details and options.

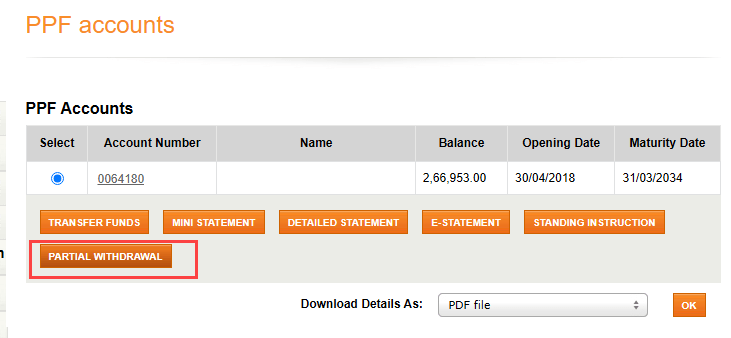

Step 3: Choose Partial Withdrawal

Within the PPF Accounts section, select the Partial Withdrawal option to begin the withdrawal process.

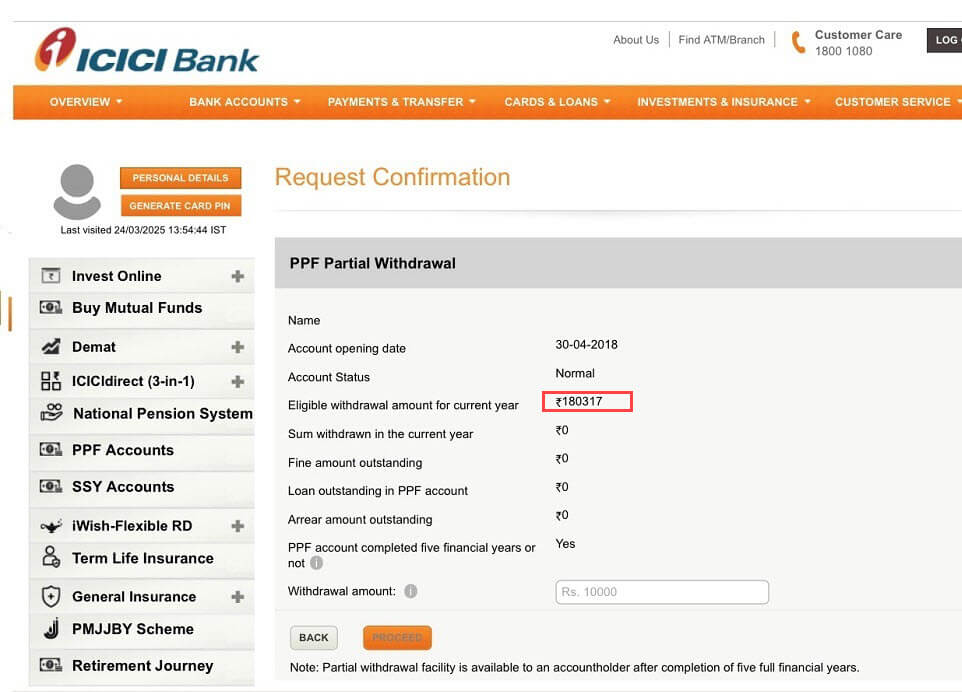

Step 4: View the Eligible Withdrawal Amount

The system will display the eligible withdrawal amount for the current year, calculated as 50% of the balance from the 4th or previous year. You can withdraw this full amount.

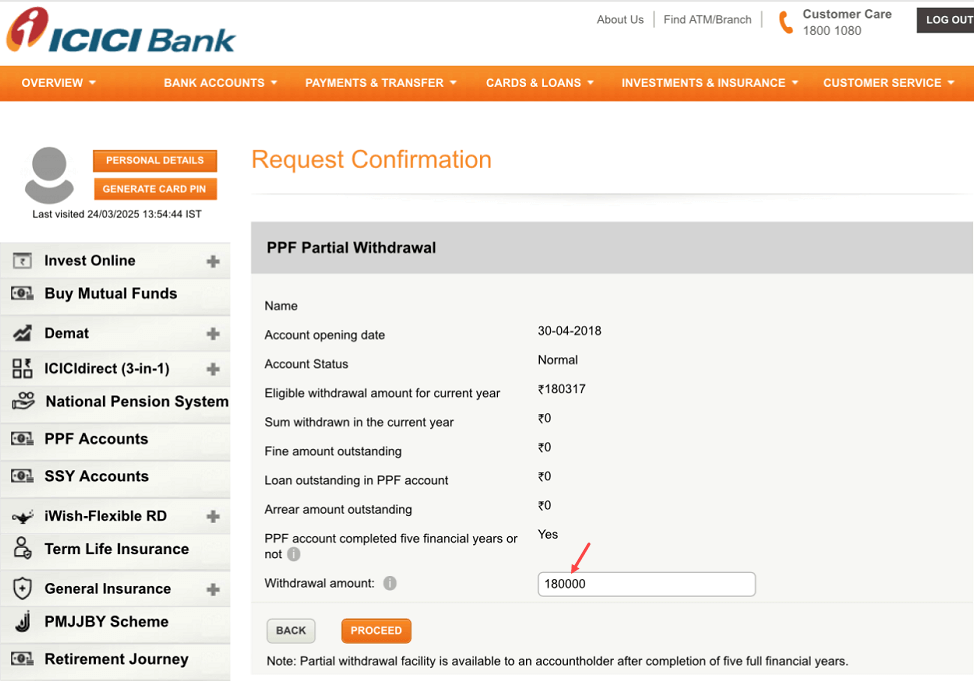

Step 5: Input the Withdrawal Amount

Enter the eligible withdrawal amount shown on the screen and click Next to proceed.

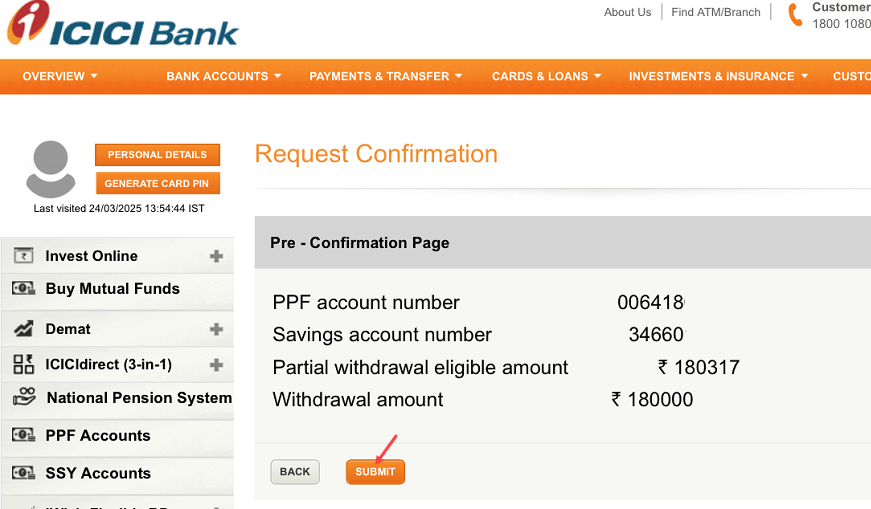

Step 6: Submit the Withdrawal Request

Review the withdrawal details on the next page and click Submit to confirm your PPF withdrawal request.

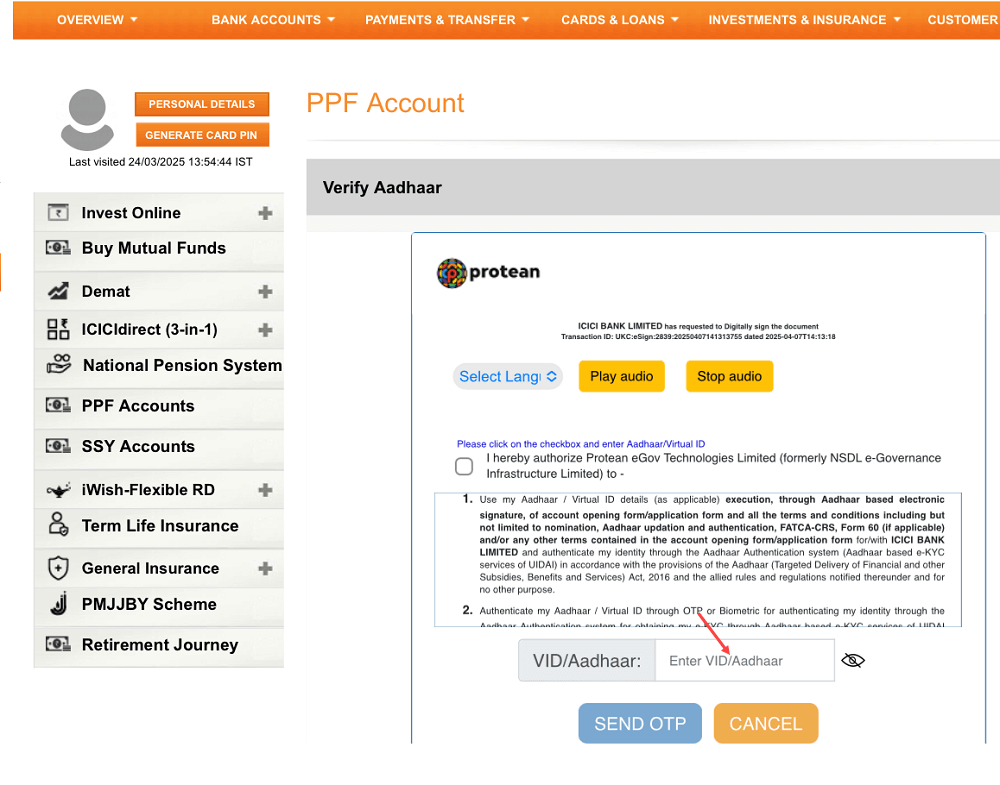

Step 7: Authenticate with Aadhaar

For verification, enter your Aadhaar card number in the provided field and submit it to proceed.

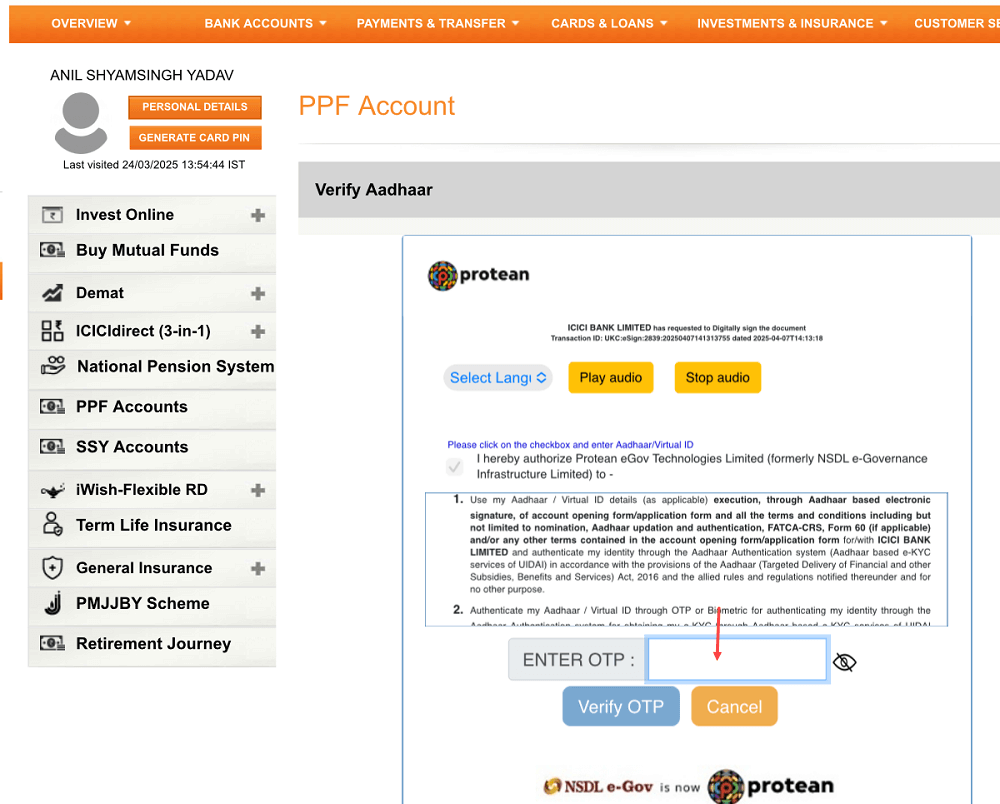

Step 8: Enter the OTP

An OTP will be sent to your Aadhaar-linked mobile number. Input the OTP to authenticate your identity.

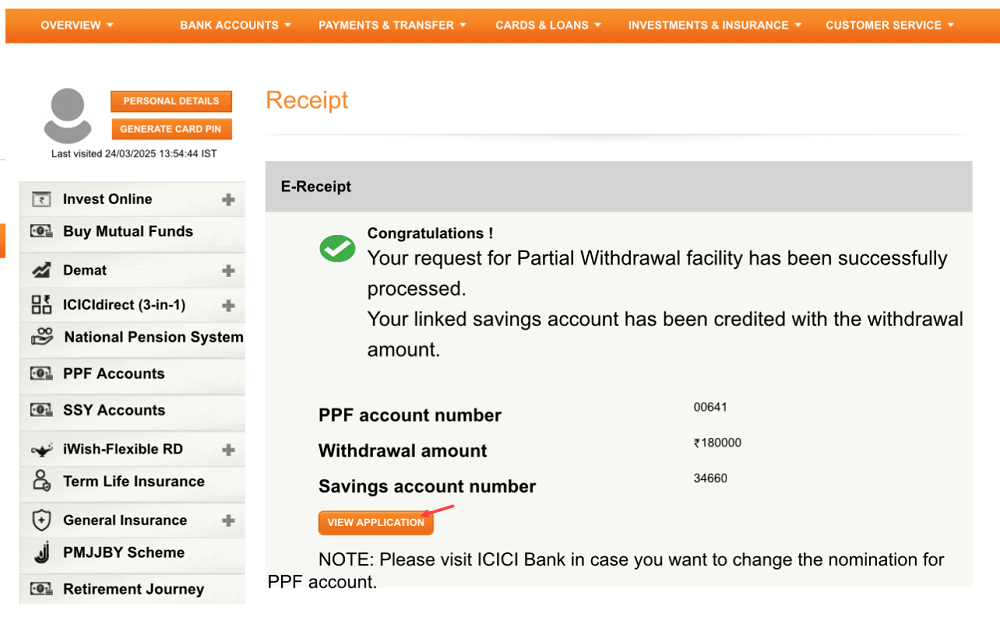

Step 9: Receive Withdrawal Confirmation

Once verified, you’ll see a message confirming your partial withdrawal was successful.

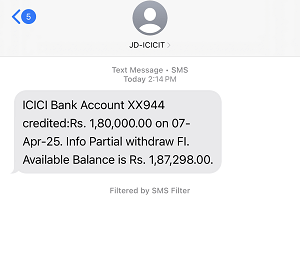

Step 10: Instant Fund Transfer

The withdrawn amount will be instantly credited to your linked ICICI Bank savings account. You’ll receive an SMS confirming the PPF withdrawal transaction.

Important Notes

- Tax-Free Withdrawals: PPF withdrawals are exempt from tax under Section 80C, thanks to the EEE (Exempt-Exempt-Exempt) status.

- Annual Limit: Only one partial withdrawal is allowed per financial year, up to 50% of the eligible balance.

- Digital Efficiency: ICICI Bank’s online banking ensures quick and secure PPF withdrawals with Aadhaar-based authentication.

- Alternative Option: If your account is 3–6 years old, consider a PPF loan (up to 25% of the balance) to avoid depleting your savings.

Benefits of Managing Your PPF Account with ICICI Bank

ICICI Bank enhances your PPF account experience with:

- Instant online PPF account opening for existing customers.

- Automated deposits via standing instructions (₹500–₹1.5 lakh annually).

- Easy access to statements and transactions through Internet Banking or the iMobile Pay App.

- Seamless fund transfers to your PPF account using NEFT or ECS.

The PPF interest rate is currently 7.1% per annum (as of April 2025), compounded yearly, making it a reliable investment.

Final Thoughts

With ICICI Bank’s online banking, performing a partial PPF withdrawal is fast and secure. By logging into Internet Banking, selecting the PPF withdrawal option, and verifying with Aadhaar, you can access your funds instantly. Ensure you meet the eligibility criteria and verify the withdrawal amount to balance your savings goals.