Yesterday, I had to transfer ₹ 2,45,000 from my Axis Bank account to my brother’s bank account. However, as you know, UPI has a limit of ₹ 1 lakh for transferring funds to any bank account. Here IMPS Money Transfer on Axis Mobile Banking helped me.

With Axis Mobile Banking IMPS instant money transfer facility, you can transfer up to 5 lakh to any bank account. So if you want to send a big amount and your UPI limit has been exceeded then follow this step-by-step guide and send money to the beneficiary account with IMPS instantly. Read also: Check your Axis and Aadhaar linking status online

How to Send Money With IMPS on Axis Mobile Banking

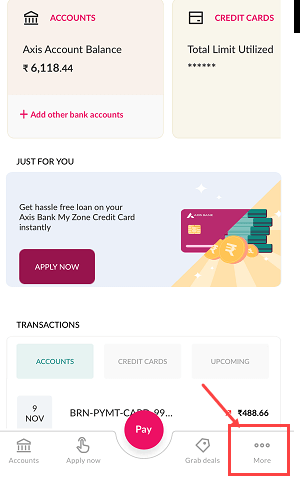

(1) Launch the Axis Mobile Banking application and login with your mpin. After login, on the main screen, tap and open “More”

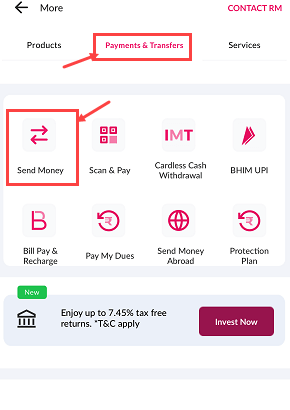

(2) Once you open the More section, tap and open the “Payments & Transfers” section where you will find the “Send Money” option. With the Send Money option, you can send money through IMPS. Other payment options like NEFT are also available.

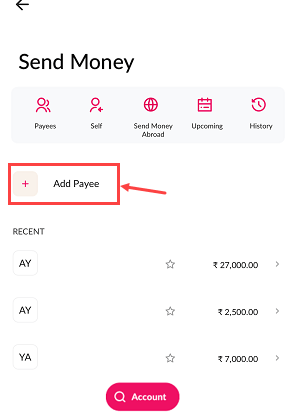

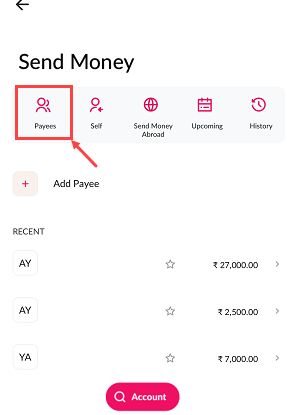

(3) First we will add the payee bank account and then we will transfer money to the payee bank account through IMPS. So tap on the “+Add Payee” option. If the payee has already been added, you can see the payee’s name in the recent list, you can choose the payee and transfer money.

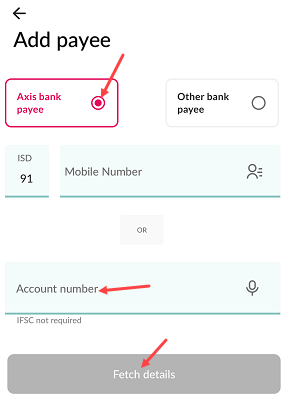

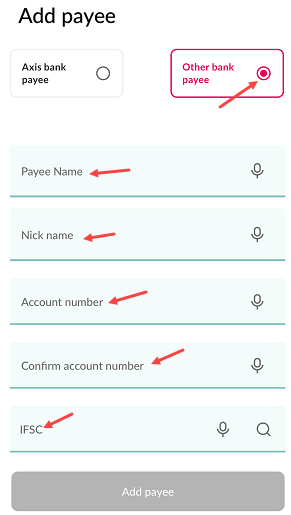

(4) If the payee has an Axis Bank account then you don’t need to enter the IFSC code and account details will be collected with the account number. Just choose the “Axis bank payee” option and enter his/her registered mobile number OR account number and tap on the fetch details.

(5) On the other hand, if the payee has other bank accounts, you can select the “Other bank payee” option, enter the account number, name and IFSC code details and tap on the Add payee button.

Once you have added a payee bank account, it will be activated and you can transfer money to this payee account through IMPS and NEFT by selecting Send money option. Let’s see step by step process.

(6) Tap on the Send Money option, now tap on the “Payees” option to open your payee’s saved list. You can view and manage all your saved payees by selecting the “Payees” option.

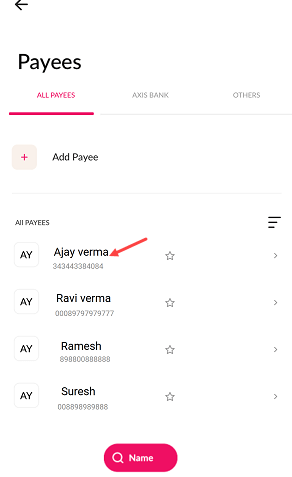

(7) You can view all your saved payees here. Just choose and tap on your payee name for the money transfer.

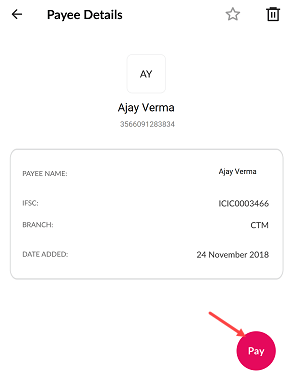

(8) Once you click on the payee name, you can view the payee details on the next screen. If the payee is correct then tap on “Pay” to initiate the IMPS transfer.

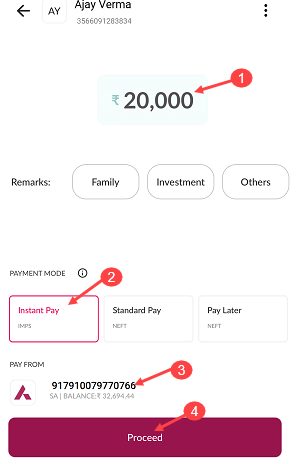

(9) Next screen, enter the amount, and remarks, in the payment mode – select the “Instant Pay IMPS” option, select your bank account for debit and proceed.

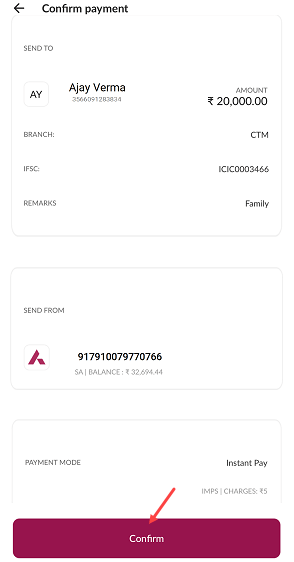

(10) Next screen you can review your IMPS transaction details. Tap on the confirm button to proceed.

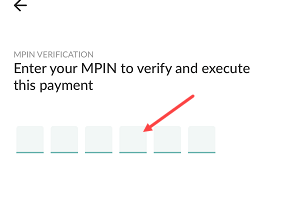

(11) In the last step, enter your MPIN to authenticate the IMPS transaction.

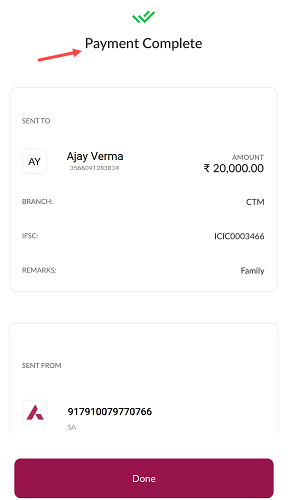

(12) Once you enter the MPIN, your IMPS money transfer will be completed and money will be sent and credited to the payee bank account instantly.

Axis Mobile Banking IMPS money transfer facility is available 24/7 including bank holidays which means you can transfer money anytime. The limit for IMPS transfer is Rs. 5 lakh per transaction.