HDFC Bank customers can create an official UPI account and UPI ID without setting up a UPI PIN and no debit card is required. You don’t need to install any other UPI application to access UPI services like sending and receiving money.

Here we will guide you step by step on how to create UPI account on HDFC mobile banking without Debit Card and UPI PIN.

The Easiest Way to Create a UPI Account for HDFC Bank Customers

To create a UPI account and UPI ID through the HDFC mobile banking app, follow these steps:

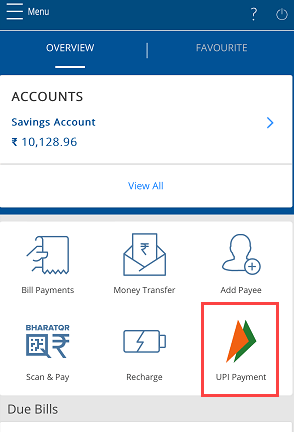

Step 1: Open the HDFC Mobile Banking App and Log In.

Step 2: After login, navigate to the “UPI Payment” Section.

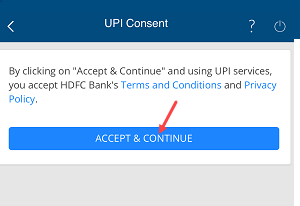

Step 3: You’ll now be prompted to review and accept the terms and conditions associated with UPI services. Tap on the “Accept” button to proceed.

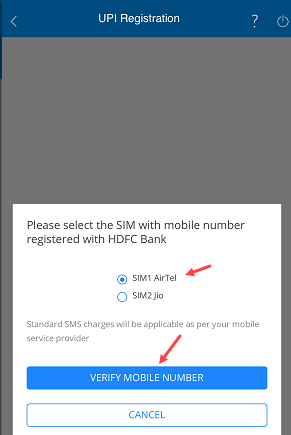

Step 4: To verify your mobile number, the app will send an automatic SMS to your registered mobile number. Select the SIM card linked to your registered mobile number and tap on “Verify mobile number.” Ensure your mobile phone has enough balance to send the SMS for verification.

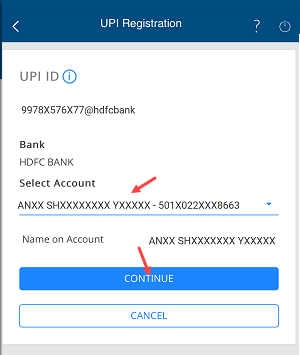

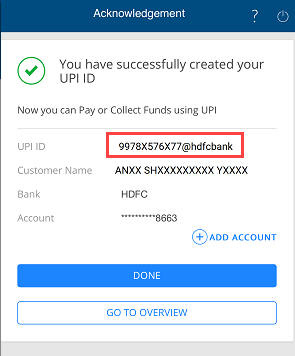

Step 5: Following the successful validation of your registered mobile number, the app will generate your unique UPI ID, which will typically include “@hdfcbank.” you’ll need to choose your HDFC Bank account number and tap on “continue” to link this account with your newly created UPI ID.

Step 6: Congratulations! You’ve Now Successfully created Your UPI Account. Your official UPI ID is now ready to use. Usually, your UPI ID will be created using your mobile number. You can share your UPI ID with others to receive money to your bank account.

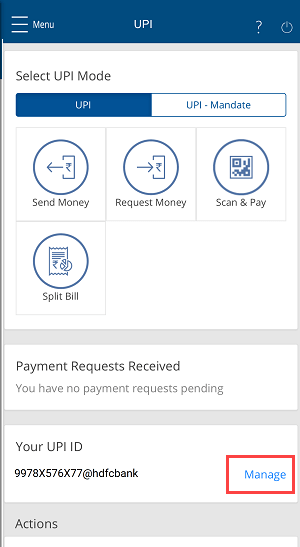

Step 7: To access your UPI account on HDFC mobile banking, simply open the “UPI Payment” section and here you can see the Send Money, Receive Money, Scan & Pay options to make send/receive money. You can also view your UPI ID here.

There are several advantages to creating a UPI account through HDFC mobile banking:

- No need to set up a UPI PIN: This is a major convenience, as it eliminates the need to remember and enter a separate PIN for every UPI transaction.

- Convenient and secure: The HDFC mobile banking app is a trusted and secure way to manage your HDFC accounts. UPI transactions made through the app are also protected by advanced security features.

- Streamlined UPI transactions: With your HDFC UPI account, you can easily send and receive money, make online payments, and more, all from the convenience of the HDFC mobile banking app.

Overall, HDFC Bank customers can benefit from a seamless and efficient UPI experience by creating their UPI account and UPI ID using the HDFC mobile banking app.

If you are an HDFC Bank customer, I encourage you to create your UPI account and UPI ID using the HDFC mobile banking app. It is a convenient, secure, and efficient way to use UPI services.