Transferring money online has never been easier with HDFC Mobile Banking. Among the available options, NEFT (National Electronic Funds Transfer) is a secure and efficient way to transfer funds to any bank account in India. This article explains everything you need to know about NEFT, including transfer limits, processing time, and step-by-step instructions to complete the process.

What is NEFT?

NEFT is an electronic fund transfer system regulated by the Reserve Bank of India (RBI). It enables seamless money transfers between accounts in different banks.

NEFT Features You Should Know:-

- Transfer Amount:

- No minimum limit for transfers.

- Maximum limits depend on your HDFC account and the daily transaction cap.

- Processing Time:

- Transfers are typically credited within 1 hour during banking hours.

- Transactions made after business hours will be processed in the next batch.

Before You Begin

Before using NEFT, ensure the recipient’s account is added as a payee in your HDFC Mobile Banking app. If you’re unsure how to add a payee, follow this detailed guide.

Transfer Money via NEFT from HDFC Mobile Banking

Follow these simple steps to initiate an NEFT transaction once your payee has been added and completed 4 hours. Full limit will be activated after 24 hours, but after 4 hours you can transfer money through NEFT under limit.

Step 1: Wait for Payee Activation

After adding a payee, wait for 4 hours before initiating any transactions.

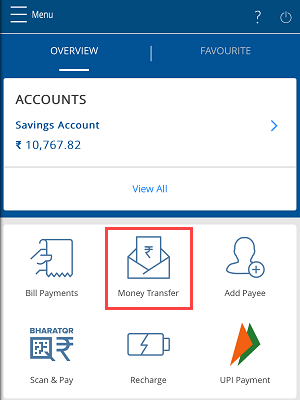

Step 2: Access the Money Transfer Section

Log in to the HDFC Mobile Banking app and tap on the Money Transfer tab.

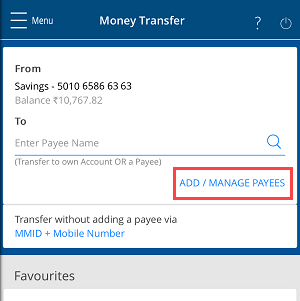

Step 3: Manage Payees

Select Add/Manage Payee to view your list of added payees.

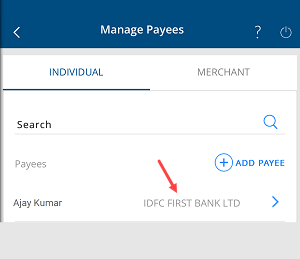

Step 4: Select the Payee

From the list, choose the payee to whom you wish to send money and click Proceed.

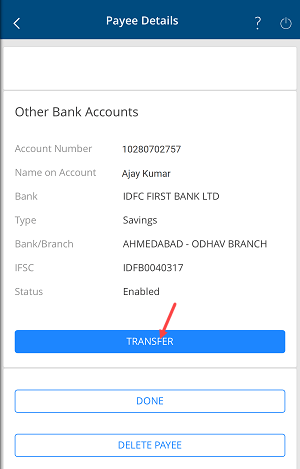

Step 5: Initiate Transfer Process

Next screen, you can see “Transfer” button, press this button and initiate NEFT transfer.

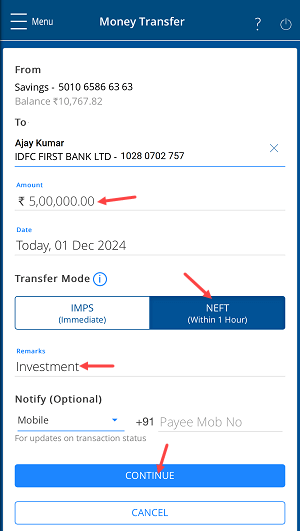

Step 6: Input Transfer Details

Enter the amount you want to transfer. Choose the NEFT option. Add a reason for the transfer in the remarks section. Tap Continue.

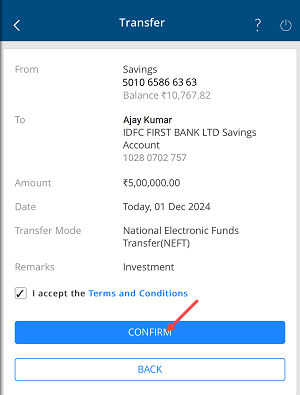

Step 7: Confirm Your Transaction

On the next screen, verify all details and click Confirm.

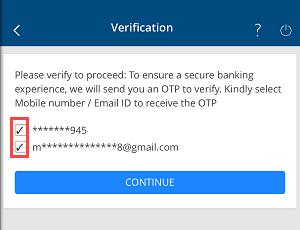

Step 8: OTP Verification

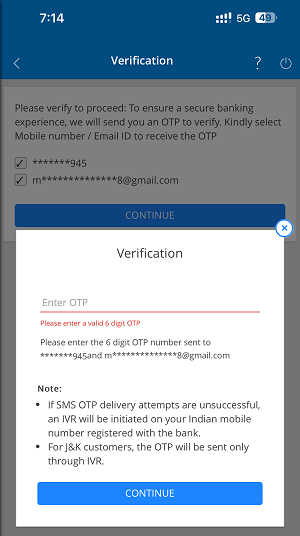

Select your mobile number and email ID to receive the OTP. You can select any one and press continue.

Enter the OTP sent to your registered mobile number and email ID in the provided field to authenticate the transaction.

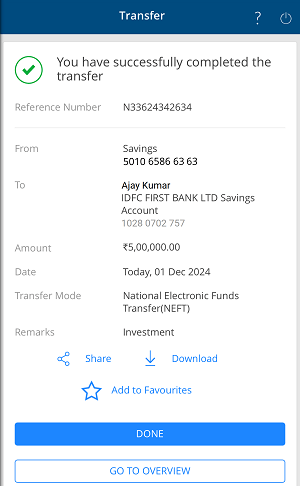

Step 9: Successful Transfer

Your NEFT transaction is now complete! The amount will be deducted from your HDFC account and credited to the payee’s account within 1 hour. Save or download the NEFT receipt and share it with the recipient for confirmation.

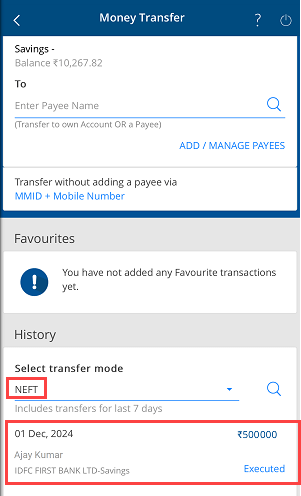

How to Check NEFT Transfer Status on HDFC Mobile Banking

Wondering if your transfer went through? HDFC Mobile Banking makes it easy to check the status of your NEFT transaction:

- Open the Money Transfer section and navigate to History.

- Select the NEFT option to view completed or pending transactions.

- Tap on the specific transaction for more details.

If the status shows Executed, it means the money has been successfully credited to the recipient’s account.

Benefits of Using NEFT in HDFC Mobile Banking

- Secure: All transactions are regulated by RBI.

- Convenient: Available 24×7 from the comfort of your mobile.

- Affordable: Minimal or no transaction charges.

By following this guide, you can easily perform NEFT transactions via the HDFC Mobile Banking app. This method ensures a smooth, safe, and quick transfer process. Always double-check your transaction details for a hassle-free experience.