Keeping your bank account details up-to-date is important, especially your mobile number. This is because your mobile number is used to receive important banking notifications and updates, such as fund transfers, debit card transactions, and password resets.

If you need to register a new mobile number online with your Central Bank of India account, you can do so by following these simple steps:

Tips for registering a new mobile number online with Central Bank of India

- Make sure that you have a strong internet connection before you start the process.

- Have your debit card details and current registered mobile number handy.

- Keep your new mobile number with you so that you can enter the verification code when prompted.

Registering a new mobile number online with the Central Bank of India Account

To register a new mobile number online with your Central Bank of India account in more detail, follow these steps:

(1) Visit the Central Bank of India net banking website (https://www.centralbank.net.in) Enter your user ID and password and click on the “Login” button.

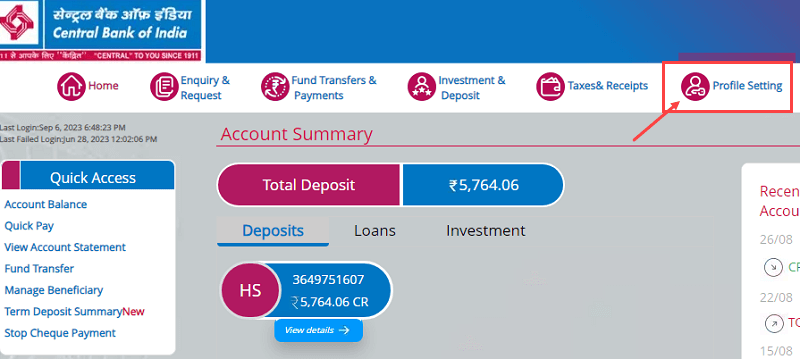

(2) When you login successfully, Click on the “Profile Setting” tab. This tab is usually located in the top right corner of the screen.

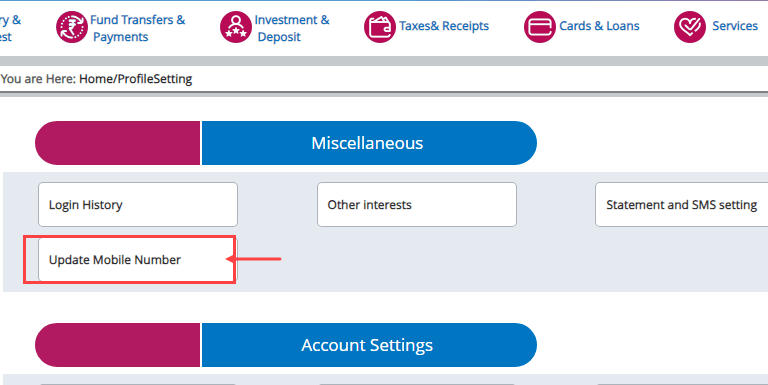

(3) Under the “Profile Setting” section, click on the “Update Mobile Number” link.

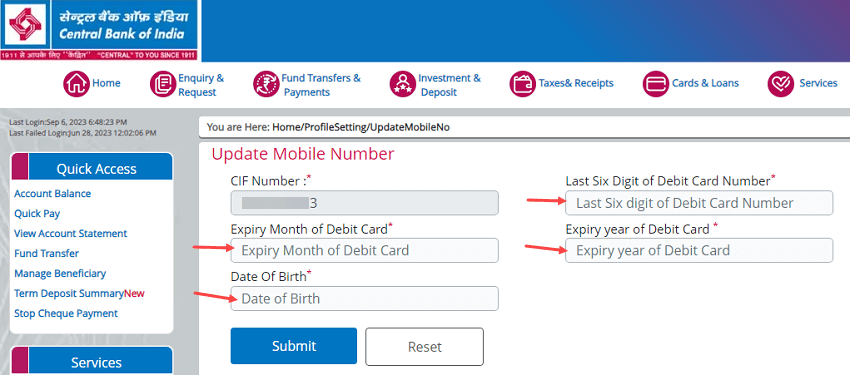

(4) Now enter the last six digits of your debit card number, the expiry month of your debit card, the expiry year of your debit card and your date of birth and click on the “Submit” button.

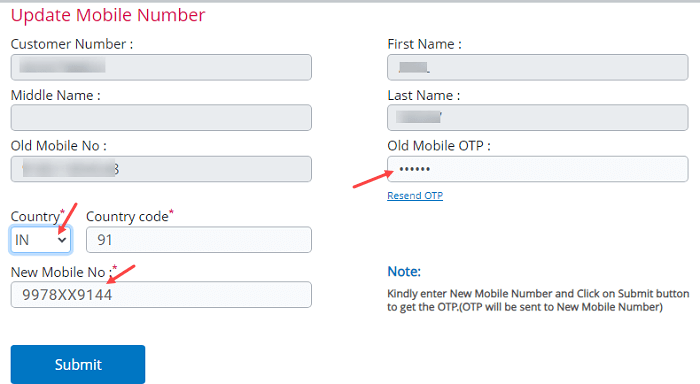

(5) You will receive a verification SMS (OTP) on your old current registered mobile number. Check your SMS inbox for the OTP. Enter this OTP on “Old Mobile OTP”, select the country code (IN) and enter your new mobile number and submit.

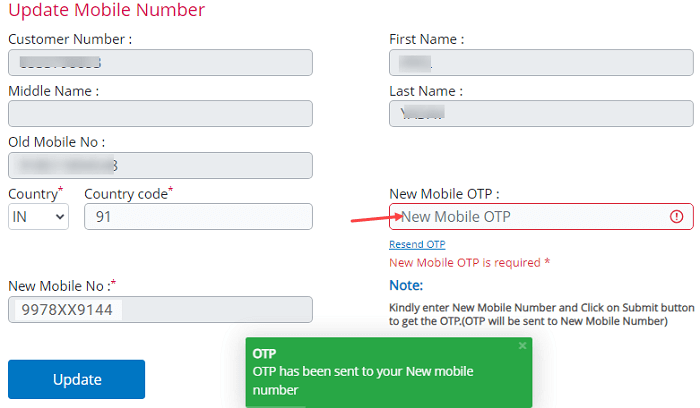

(6) Next screen enter the verification code (OTP) received on your newly entered mobile number in “New Mobile OTP” and click on the update.

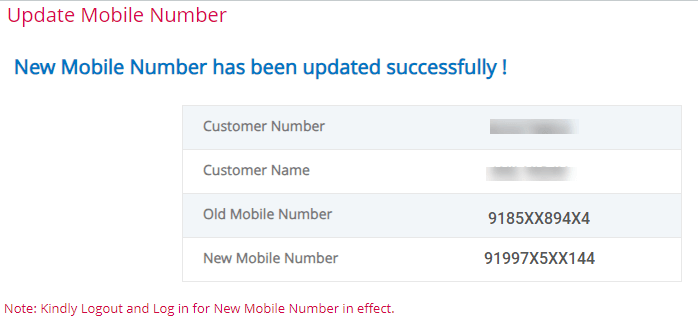

(7) Your mobile number will be updated successfully. You will receive a confirmation message on your new mobile number.

Once you have successfully registered your new mobile number online, you will be able to use it to receive important banking notifications and updates, such as fund transfers, debit card transactions, and password resets and OTPs.