Have you heard about Paytm’s UPI Lite feature that allows you to make payments of up to INR 500 without entering your UPI PIN? If not, we’re here to guide you on how to use this Paytm UPI Lite feature. Before that, let me provide you with more information about this PIN-less payment facility.

What is Paytm UPI Lite Feature?

When we transfer money using UPI from any UPI application such as PhonePe, Paytm, Gpay, or any other, we are required to authenticate the transaction with a UPI PIN. While this security measure is important for larger transactions, it can become a bit cumbersome when you need to make frequent small payments, such as at local shops or when transferring small amounts like 100, 200, or 300 INR to family and friends’ bank accounts.

The NPCI has recently launched a new feature called UPI Lite, which lets you pay small amounts without a UPI PIN. With UPI Lite, users can make small payments of up to 500 rupees without having to enter their UPI PIN. Read also: How to deactivate Paytm UPI account

The process is simple: just activate the UPI Lite feature and add money to your UPI Lite account (which has a maximum limit of 2000 INR). Once you’ve done this, you can make payments of up to 500 rupees at any shop or transfer funds to any bank account via UPI Lite without having to enter your UPI PIN.

How To Activate UPI Lite on Paytm App

To activate the UPI Lite feature on Paytm, you just need to add money to the UPI Lite account from your linked bank account. Please follow our step-by-step guide below:

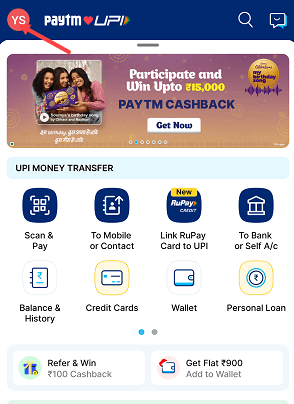

(1) Launch the Paytm Application and tap on the profile photo to open the Profile.

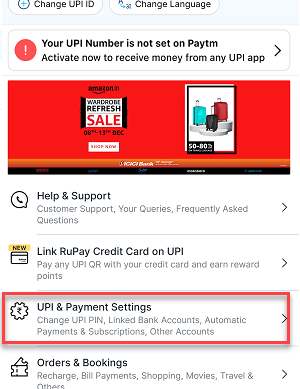

(2) Now click and open “UPI & Payment Settings”

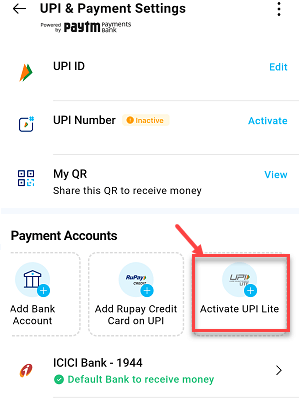

(3) Next screen you can see the “Activate UPI Lite” option. Click and proceed.

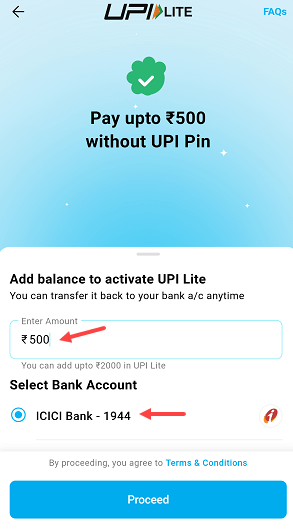

(4) Now add money to your UPI Lite from your linked bank account. You can add up to INR 2000 to UPI Lite. Enter the amount, select your bank account and proceed to add. Please note one thing, your selected bank account which is used to add money, will become your default account to add money to UPI Lite, no other bank account can be to add money.

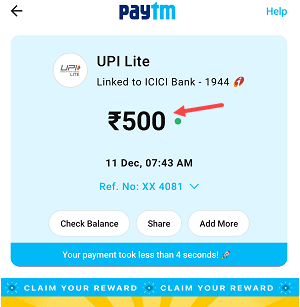

(5) You will be asked to enter the UPI PIN to complete the transaction. Once you have submitted your UPI PIN, money will be added to your Paytm UPI Lite account.

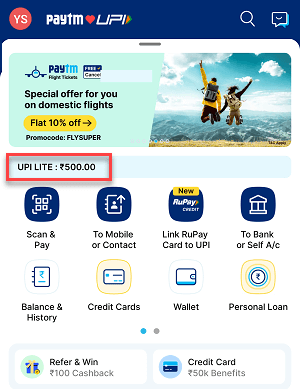

(6) Congrats, UPI Lite successfully activated on your Paytm application. You can view the “UPI Lite” section on the main home page of your Paytm app. Just tap to add more balance and manage the UPI Lite account.

How To Pay With Paytm UPI Lite OR Transfer Money

Once your Paytm UPI Lite is activated, you can pay or transfer money from your UPI Lite balance without a UPI PIN.

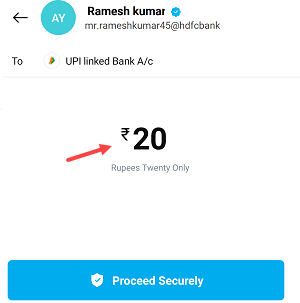

- To pay a small amount (up to 500) at the shop, just scan the QR code or enter the UPI ID/Mobile number.

- Now enter the amount and proceed to Pay.

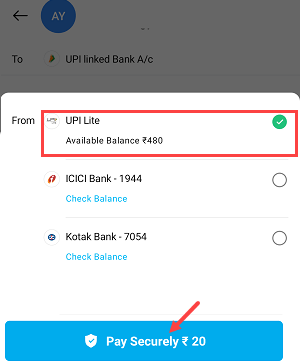

On the payment selection, choose the “UPI Lite” option and pay the amount without UPI PIN. For more info, you can view the below screenshot.

Similar way, you can easily transfer money to your family and friends’ bank accounts without the need for entering the UPI PIN. All you need to do is scan the QR code or enter the mobile number, UPI ID or bank account details of the recipient. Then, simply enter the amount you want to transfer and choose the “UPI Lite” option in the payment selection screen to make the payment. Read also: How to unlink bank account on Paytm

FAQs about Paytm UPI Lite Feature

(1) Can I withdraw money from Paytm UPI Lite to my bank account?

- Yes, you can withdraw your full money from UPI Lite to your own bank account. You can go to the UPI Lite dashboard, and you will find the “Transfer money to own account” option there Or you can enter your UPI ID and transfer the amount.

(2) Could you please clarify what is the maximum amount that can be added to Paytm UPI lite?

- You can add up to 2000 to your Paytm UPI lite account.

(3) Could you please tell me the maximum transaction limit for Paytm UPI Lite?

- You can pay up to 500 INR per transaction from your Paytm UPI Lite without UPI PIN.