Credit cards have long been popular for splitting large purchases into EMIs (Equated Monthly Installments), making payments more manageable over time. However, for those who prefer not to have a credit card or don’t meet eligibility requirements, EMI on Debit Card is a fantastic alternative. HDFC Bank’s Debit Card EMI feature allows customers to convert eligible purchases into EMIs, similar to how a credit card works. This option is ideal for customers who want the flexibility of EMIs without the need for a credit card.

With HDFC’s Debit Card EMI feature, you can make high-value purchases online or in stores without bearing the burden of paying all at once. Before making a purchase, though, it’s essential to check if you’re eligible and to know your available EMI limit. Here’s a detailed guide on two simple ways to check your HDFC EMI on Debit Card eligibility.

1. Checking HDFC EMI Eligibility on Debit Card via Missed Call

HDFC provides an easy missed call service to instantly check if you qualify for EMI on your debit card. Here’s how you can use it:

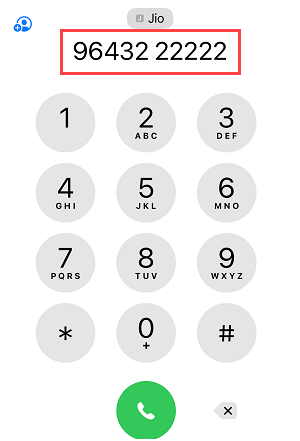

- Step 1: From the mobile number registered with your HDFC account, dial 9643222222. This number is designated specifically for checking EMI eligibility and won’t incur any charges, as the call will disconnect automatically.

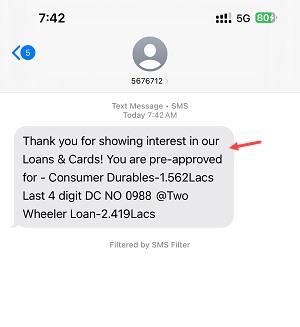

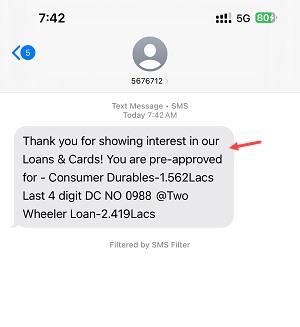

- Step 2: After the call disconnects, you’ll receive an SMS from HDFC Bank. This SMS will contain details about your EMI eligibility and the credit limit you can use for EMI on your debit card.

- Benefits of Missed Call Service: This method is quick, accessible, and cost-free, making it a popular choice for HDFC customers. With just a call, you’ll get all the necessary information to decide if you want to proceed with a purchase.

2. Checking HDFC EMI on Debit Card Eligibility via SMS

Another option to check your EMI eligibility on your HDFC Debit Card is through SMS. This service is just as fast and effective, especially if you don’t have immediate internet access.

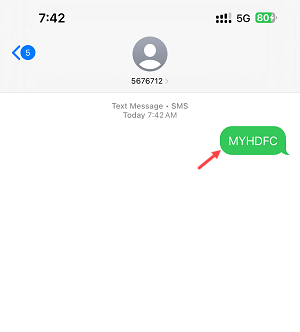

- Step 1: Open your SMS app and type MYHDFC in the message body. Send the SMS to 5676712 from your HDFC-registered mobile number.

- Step 2: You’ll soon receive a response SMS from HDFC Bank. This message will confirm your EMI eligibility and specify the credit limit available on your debit card for EMI purposes.

- Benefits of SMS Service: This method is simple and doesn’t require any data, making it ideal for those who may not have internet access at the moment. The SMS service is also a reliable way to keep track of your eligibility status whenever needed.

Why Choose EMI on a Debit Card?

For customers without a credit card, the Debit Card EMI feature provides a reliable and flexible solution. Here’s why it’s an excellent option for making large purchases:

- Credit-Free Flexibility: Debit Card EMI allows HDFC customers to enjoy installment options traditionally associated with credit cards, providing a smart alternative for those who don’t qualify for or want a credit card.

- Immediate Approval: Unlike a credit card, which requires a separate application and credit check, Debit Card EMI eligibility is often pre-approved based on your banking relationship and transaction history.

- No Additional Documentation: Since eligibility is linked to your account, there’s no need for extra paperwork. With a simple call or SMS, you can determine if you qualify for EMI.

- Wide Acceptance: HDFC Debit Card EMI is accepted across multiple online shopping platforms and select stores, giving you access to various brands and products.

Bonus Tip: Check EMI Eligibility Online with AskEVA

If you prefer a digital solution, you can also use HDFC’s AskEVA chatbot to check your EMI eligibility on your debit card:

- Visit HDFC’s Official Website: Open the HDFC Bank website on your browser.

- Open AskEVA Chatbot: Click on the chatbot icon to open AskEVA.

- Type “EMI on Debit Card” in the chat window. AskEVA will display your eligibility information and debit card EMI limit.

Conclusion

With EMI on Debit Card, HDFC Bank brings credit-free installment payments within reach for those without a credit card. Checking your eligibility is quick and easy using HDFC’s missed call or SMS service. This way, you can stay informed about your spending capacity and make purchasing decisions confidently. Whether you’re shopping online or in-store, HDFC Debit Card EMI makes it easier than ever to manage your payments effectively.