Bank to Bank money transfer using Paytm is easy and fast and you can send money from your bank account to other bank accounts instantly. No net banking or mobile banking needed.

Normally, you need net banking or mobile banking facility to send money from your account to other bank accounts. Also, you need to register payee account first and then you will be able to send money. The Bank also deduct charges for fund transfer.

But now Bank to Bank online money transfer becomes easier after the launching of BHIM UPI. Paytm has implemented BHIM UPI facility to send money bank to bank without any charges.

Here is step by step process – How you can do Bank to Bank money transfer using Paytm.

Paytm – Bank To Bank Money Transfer

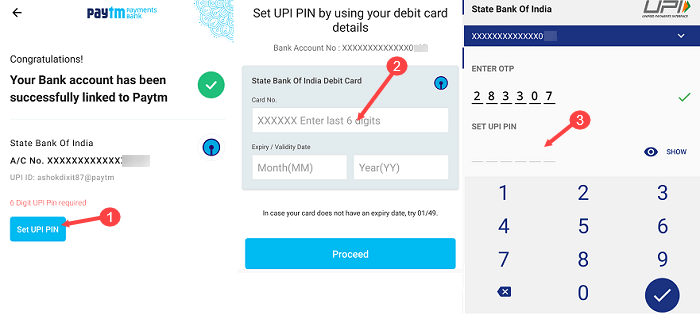

The first step is to link your Bank account with Paytm BHIM UPI. Paytm verify your bank registered mobile number and show your account number. Make sure Bank registered mobile number inserted in your phone.

Now see how you can send money from your bank account to any other bank account:-

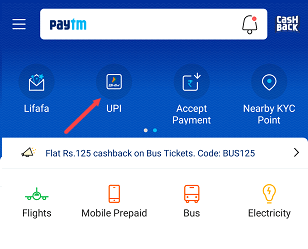

Step 1: Open Paytm application and tap on UPI icon as you can see below screenshot.

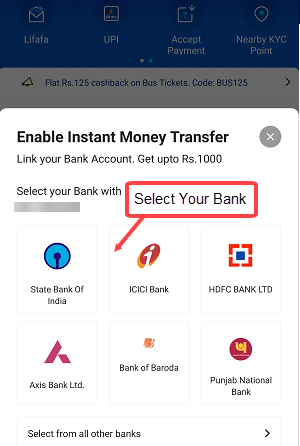

Step 2: Now select your Bank. BHIM UPI support all banks, select your Bank.

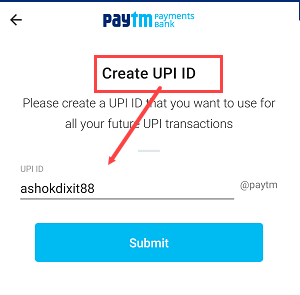

Step 3: And now create your UPI ID. This UPI ID directly linked with your Bank account so you don’t need to share your account number when you are receiving money. Create UPI ID and submit. (For example: ashokdixit67@paytm)

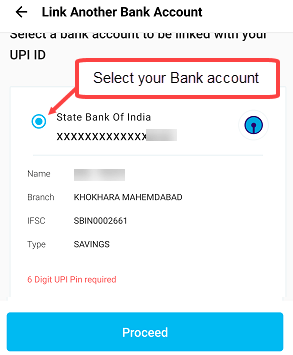

Step 4: You can see your Bank account details on next screen. Select your Bank account and proceed.

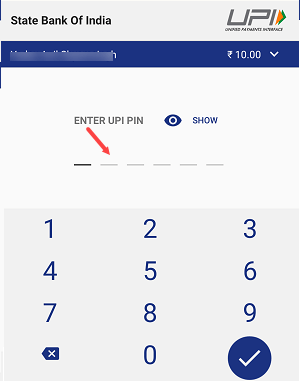

Step 5: Now set UPI PIN. This PIN requires when you send money to someone or pay using your UPI ID to the merchant website. Tap on Set UPI PIN and next screen enter your Bank ATM Debit card last 6-digits, expiry date and proceed. You will receive OTP on your Bank registered mobile number, enter OTP and set 4 or 6 digit UPI PIN.

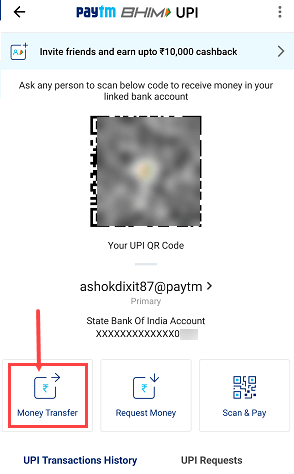

Now you are ready to send money from your bank account to any other Bank account.

Step 6: Open UPI option again in Paytm and tap on Money Transfer option as you can see below screenshot.

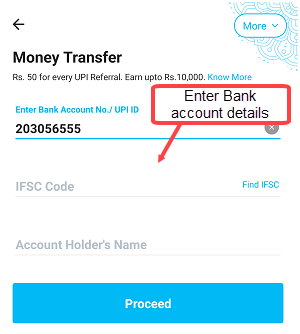

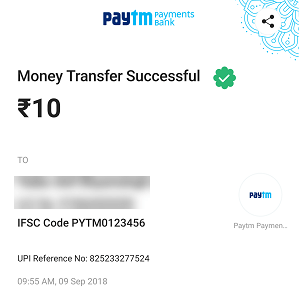

Step 7: Now enter person Bank account number and IFSC code. You can also enter person UPI ID if the person’s account is registered with UPI.

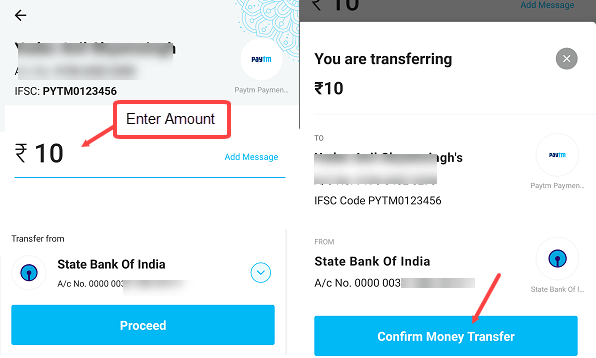

Step 8: Next, enter the amount and confirm your transfer. (Currently maximum transfer limit is 2 lac in UPI)

Step 9: Finally, enter UPI PIN to authorize your transaction.

Done! money successfully transferred to beneficiary bank account. The amount will be credited to the person’s bank account instantly.

So this is how your can do Bank to Bank money transfer using Paytm without net banking/mobile banking and charges.